ORENINC INDEX - Monday, November 18th 2019

North America’s leading junior mining finance data provider

Free newsletter sign-up at www.oreninc.com

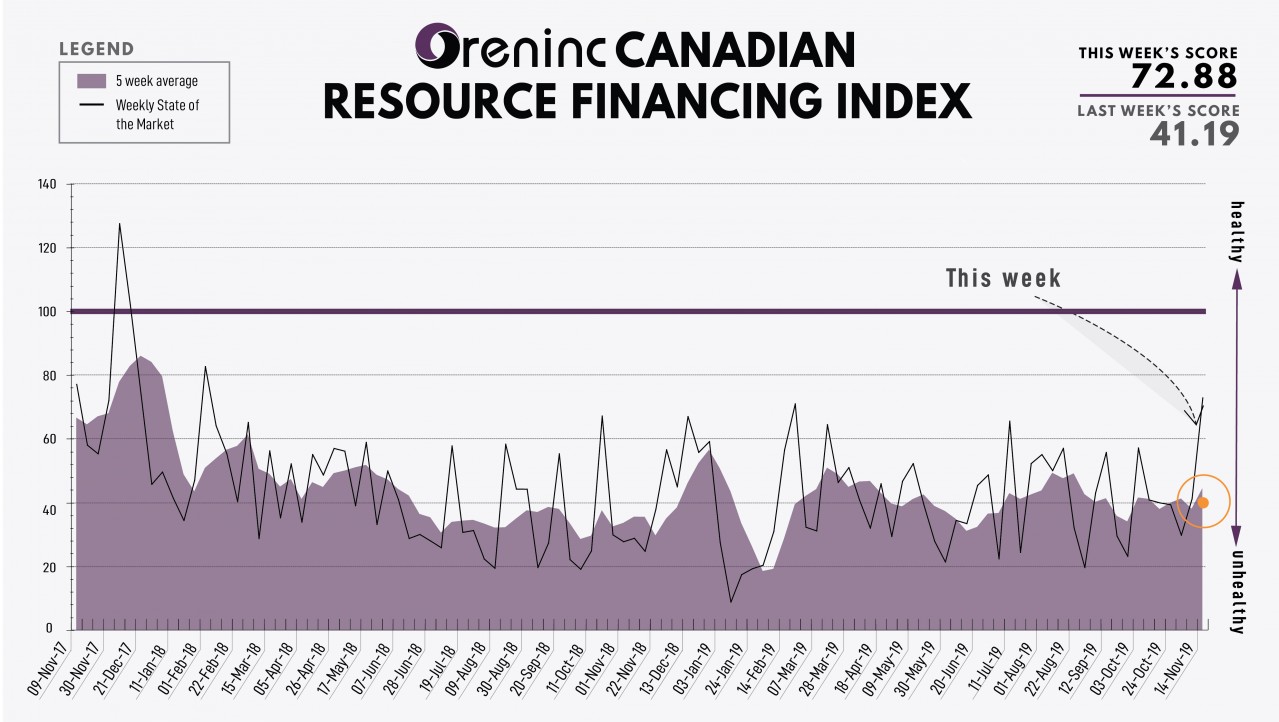

Last Week: 41.19

This week: 72.88

The Oreninc Index jumped in the week ending November 15th, 2019 to 72.88 from 41.19 a week ago as bought deals returns and almost C$100 million in deals was announced.

The gold price claimed back a small part of what it lost the previous week in what was a relatively tranquil week.

A relatively quiet week in the US with the news cycle focused on the possibility of impeachment of President Donald Trump.

The UK general election contest got into full swing with incumbent Boris Johnson and opposition leader Jeremy Corbyn engaged in a one-upmanship contest. Corbyn said he would make high-speed internet free, which parts of the press labelled broadband nationalisation, and which Johnson dismissed as a “crazed communist scheme”.

Volatile times in parts of Latin America continue as right-wing senator Jeanine Áñez assumed the presidency on Bolivia on an interim basis following the Evo Morales fleeing into exile in Mexico. Áñez said she would organise a presidential election to pick the next president but said she would ban Morales for standing again. Her interim cabinet is devoid of indigenous representation, something which was a constant feature of Morales’ rule since 2006, provoking protests around the country. In all likelihood, the situation will get worse before it gets better.

The situation in Chile appears to be calming after lawmakers agreed to hold a referendum to draft a new constitution to replace the 1980 constitution which has been a constant nagging reminder to the left of the dictatorship of August Pinochet as it was created during his rule. The constitution set Chile on a neoliberal path which many protestors in the past month of disturbances say enshrine social inequality and enrichment of a narrow elite.

On to the money: total fund raises announced increased to $99.86 million, a 15-week high, which included five brokered financings for $59.31 million, an 18-week high, and three bought-deal financings for $50.0 million, a 13-week high. The average offer size increased by more than double to $3.22 million, a 12-week high, while the number of financings increased to 31.

Spot gold clawed back some of the ground lost the previous week as it closed up at US$1,468/oz from $1,459/oz a week ago. The yellow metal is up 14.48% so far this year. The US dollar index came off last weeks’ level as it closed down at 97.99 from 98.35. The VanEck managed GDXJ closed up at US$37.14 from $36.33 a week ago. The index is now up 22.90% so far in 2019. The US Global Go Gold ETF closed up at US$15.59 from $15.30 from $16.55 a week ago. It is up 36.63% so far in 2019. The HUI Arca Gold BUGS Index closed up at 210.09 from 203.62 last week. The SPDR GLD ETF inventory continued to sell off as it closed down at 986.77 tonnes from 901.19 tonnes a week ago.

In other commodities, silver closed up at US$16.96/oz from $16.81/oz a week ago. Copper lost a few cents as it closed down at US$2.65/lb from $2.68/lb a week ago. The oil price continued to strengthen as WTI closed up at US$57.85 a barrel from $57.24 a barrel a week ago.

The Dow Jones Industrial Average continued to grow as it closed up at 28.004 from 27,681 a week ago. Canada’s S&P/TSX Composite Index also rose as it closed up again at 17,028 from 16,877 the previous week. The S&P/TSX Venture Composite Index closed down at 528.58 from 533.93 last week.

Summary

- Number of financings increased to 31.

- Five brokered financings were announced this week for $59.31m, an 18-week high.

- Three bought-deal financings were announced this week for $50m, a 13-week high.

- Total dollars increased to $99.86m, a 15-week high.

- Average offer heightened to $3.22m, a 12-week high.

Financing Highlights

Osisko Mining (TSX:OSK) opened a bought deal private placement to raise $25 million.

- Syndicate of underwriters consisting of Canaccord Genuity and Eight Capital.

- 5.3 million flow-through shares @ $4.70.

- Proceeds will be used for Canadian exploration expenses.

Integra Resources (TSXV:ITR) opened a $15 million bought deal private placement @ $1.15 which was subsequently increased to $22 million.

- Raymond James as lead underwriter and sole bookrunner.

- The company also announced a $6.6 million non-brokered private placement with Coeur Mining of 5.8 million shares @ $1.15.

- Proceeds will be used to fund exploration and pre-feasibility level study expenditures at the DeLamar gold project in Idaho, USA.

Major Financing Openings

- Osisko Mining (TSX:OSK) opened a $25 million offering underwritten by a syndicate led by Canaccord Genuity on a bought deal basis. The deal is expected to close on or about December 5th.

- Integra Resources (CSE:ITR) opened a $15 million offering underwritten by a syndicate led by Raymond James on a bought deal basis, which was later increased to $22 million.

- Probe Metals (TSXV:PRB) opened a $10 million offering on a bought deal basis. Each unit includes half a warrant that expires in two years. The deal is expected to close on or about December 10th.

- Lion One Metals (TSXV:LIO) opened a $10 million offering supported by a syndicate led by Echelon Wealth Partners and Eight Capital. Each unit includes a warrant that expires in 18 months. The deal is expected to close on or about December 4th.

Major Financing Closings

- Balmoral Resources (TSX:BAR) closed a $6.98 million offering on a best efforts basis. Each unit included half a warrant that expires in 18 months.

- Aftermath Silver (TSXV:AAG) closed a $3.3 million offering on a best efforts basis. Each unit included half a warrant that expires in three years.

- Orsu Metals (TSXV:OSU) closed a $1.44 million offering on a best efforts basis. Each unit included a warrant that expires in three years.

- Victory Resources (TSXV:VR) closed a $1.44 million offering on a best efforts basis.