Oreninc Index Doubles

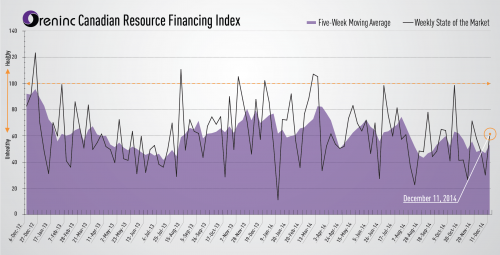

The Oreninc Index doubled for the week ending December 11, 2014. Total dollars announced jumped to $157.7m, an eight-week high. Five brokered deals were announced for $34.1m, a four-week high; three bought-deals were announced for $9.7m, a three-week high.

Deal-making continued to stay somewhat active with Vale’s (NYSE:VALE) sale of a 14% stake in its Moatize coal project in Mozambique to the Japanese trading company Mitsui & Company (TYO: 8031), who led the charge. The deal for the stake in the property is worth $638m (USD), with an additional $313m (USD) being paid by Matsui & Co. for a 35% stake in the related Nacala Logistics Corridor. Commodity prices for the week were highlighted by gold’s rise to above $1,220 an ounce, ending the week there.

It’s hard to find positives in this market, but the fact that deals are getting done and there seems to be some amount of appetite for investment as the year comes to a close is a positive. As we’ve said in weeks past, it would not be surprising to see an influx of flow-through financings in the weeks leading up to the end of the year, but it would also not be surprising if that didn’t happen given the state of the financing market. We’ll see how next week--the last Index reading of the year--will fare. No breaths should be held over the next few weeks.

Summary:

- Deals jumped to 33, a two-week high.

- Five brokered deals were announced for $34.1m, a four-week high.

- Three bought deals were announced for $9.7m, a three-week high.

- Total dollars exploded to $157.7m, an eight-week high.

- Average deal size increased to $4.8m, an eight-week high.

Major Financing Openings:

- Pretium Resources Inc. (TSX:PVG) opened a $99.13 million offering on a strategic deal basis. The deal is expected to close on or about January 16, 2015.

- Allied Nevada Gold Corp. (TSX:ANV) opened a $21.5 million offering underwritten by a syndicate led by H.C. Wainwright & Co. LLC on a best efforts basis.

- Goldsource Mines Inc. (TSX-V:GXS) opened a $7.5 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 36 months.

- Euromax Resources Limited (TSX-V:EOX) opened a $8.59 million offering on a strategic deal basis. Each unit includes a 1/2 warrant that expires in 60 months.

Major Financing Closings:

- Arsenal Energy Inc. (TSX:AEI) closed a $9.08 million offering underwritten by a syndicate led by Paradigm Capital Inc. on a bought deal basis.

- Auryn Resources Inc. (TSX-V:AUG) closed a $7.31 million offering on a best efforts basis.

- Blackbird Energy (TSX-V:BBI) closed a $7.27 million offering on a best efforts basis.

- Eastmain Resources Inc. (TSX:ER) closed a $3.89 million offering underwritten by a syndicate led by Secutor Capital Management on a best efforts basis.