ORENINC INDEX - Monday, August 29th, 2022

North America’s leading junior mining finance data provider

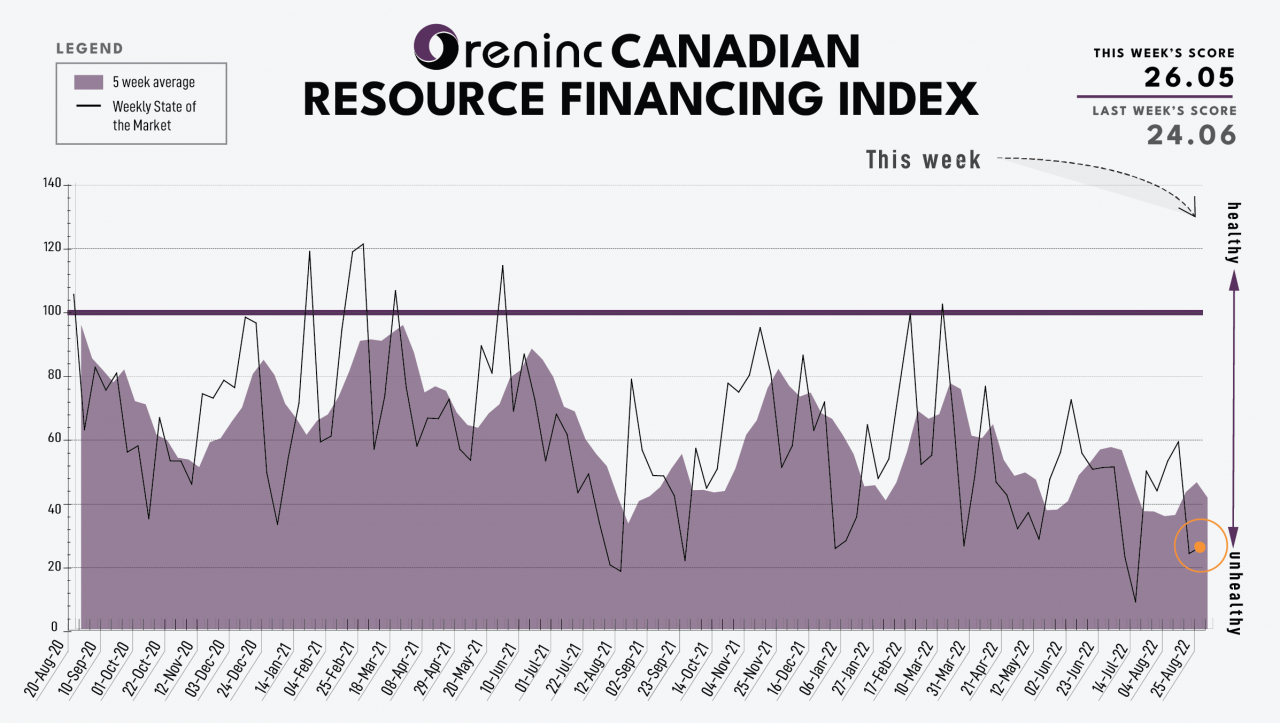

Last Week: 24.06

This week: 26.05

The Oreninc Index increased in the trading week ending August...

ORENINC INDEX - Monday, August 29th, 2022

North America’s leading junior mining finance data provider

Last Week: 24.06

This week: 26.05

The Oreninc Index increased in the trading week ending August...Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla efficitur turpis a nisl lobortis luctus. In accumsan augue lectus, non

posuere nisl gravida in. Integer orci libero, interdum id interdum euismod, molestie id tellus. Duis non facilisis nulla.

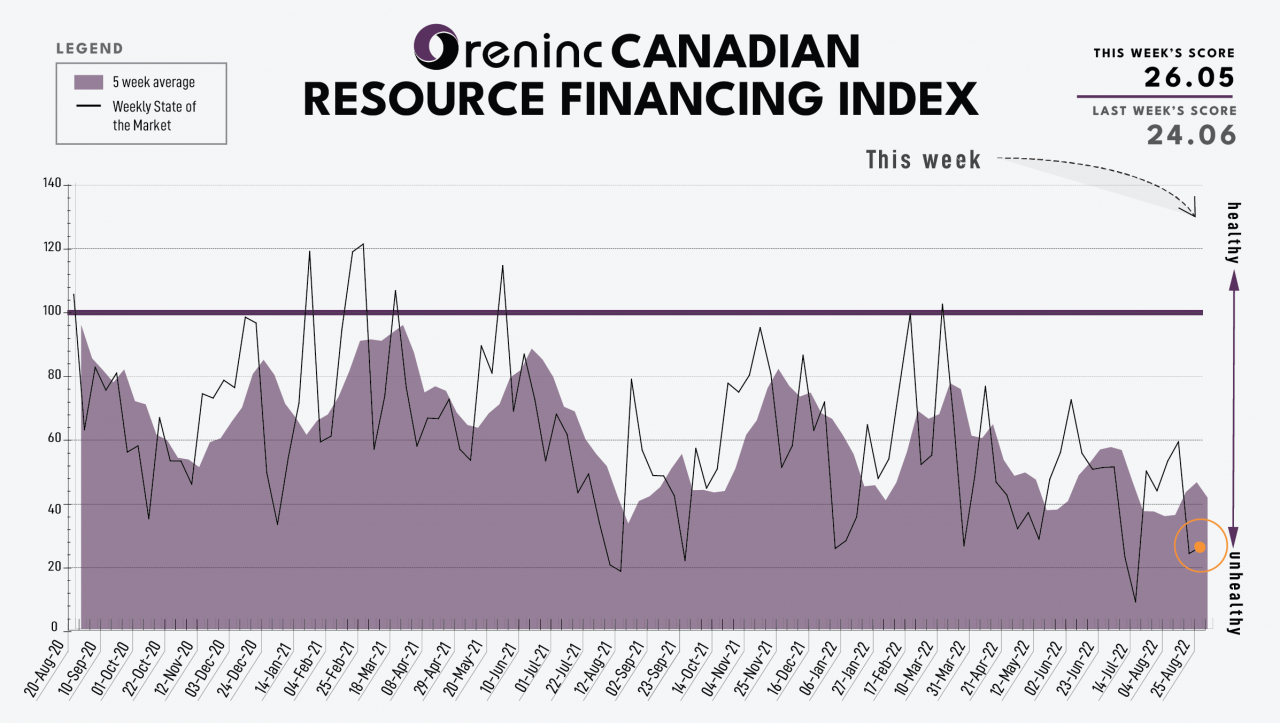

ORENINC INDEX - Monday, August 29th, 2022

North America’s leading junior mining finance data provider

Last Week: 24.06

This week: 26.05

The Oreninc Index increased in the trading week ending August...

ORENINC INDEX - Monday, August 29th, 2022

North America’s leading junior mining finance data provider

Last Week: 24.06

This week: 26.05

The Oreninc Index increased in the trading week ending August... ORENINC INDEX - Monday, August 8th, 2022

North America’s leading junior mining finance data provider

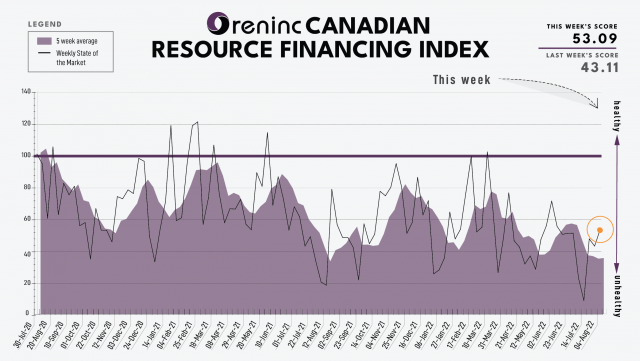

Last Week: 43.11

This week: 53.09

The Oreninc Index increased in the trading week ending August...

ORENINC INDEX - Monday, August 8th, 2022

North America’s leading junior mining finance data provider

Last Week: 43.11

This week: 53.09

The Oreninc Index increased in the trading week ending August... ORENINC INDEX - Monday, July 25th, 2022

North America’s leading junior mining finance data provider

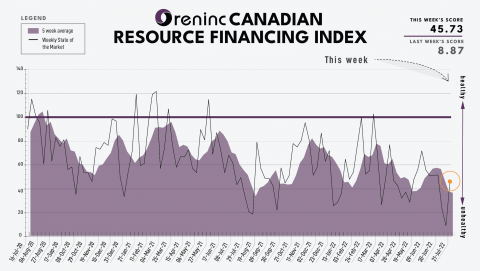

Last Week: 8.87

This week: 45.73

The Oreninc Index increased in the trading...

ORENINC INDEX - Monday, July 25th, 2022

North America’s leading junior mining finance data provider

Last Week: 8.87

This week: 45.73

The Oreninc Index increased in the trading... ORENINC INDEX - Monday, July 18th, 2022

North America’s leading junior mining finance data provider

Last Week: 23.06

This week: 8.87

The Oreninc Index decreased in the trading week ending July 15th, 2022...

ORENINC INDEX - Monday, July 18th, 2022

North America’s leading junior mining finance data provider

Last Week: 23.06

This week: 8.87

The Oreninc Index decreased in the trading week ending July 15th, 2022... ORENINC INDEX - Monday, April 18th 2022

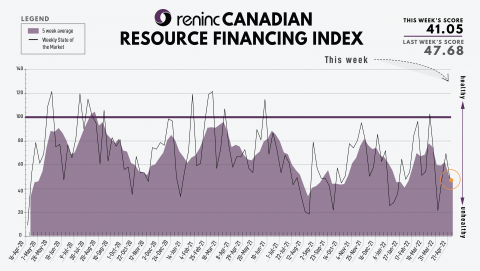

North America’s leading junior mining finance data provider

Last Week: 47.68

This week: 41.05

The Oreninc Index decreased in the trading week ending April...

ORENINC INDEX - Monday, April 18th 2022

North America’s leading junior mining finance data provider

Last Week: 47.68

This week: 41.05

The Oreninc Index decreased in the trading week ending April...