Oreninc Index Hits New Basement

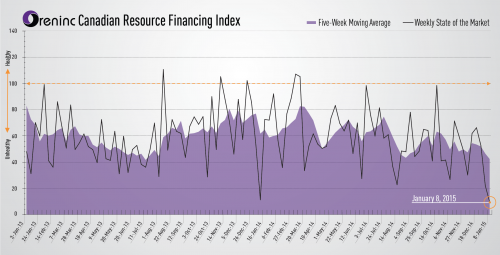

The Oreninc Index crashed to a new low for the week ending January 8, 2015. Total dollars crashed to $2.2m, its lowest level in over a year. No brokered or bought financings were announced, the second and third occurrences in as many weeks respectively. Total financings announced dropped to 10, the lowest level in one year.

Deals for the week were light--as expected, considering the proximity to the start of the year. The largest deal was Cliffs Natural Resources’ (NYSE:CLF) sale of their West Virginian Logan County Coal assets to Coronado Coal’s subsidiary, Coronado Coal II, for $174m. Both the company and its subsidiary are private. Gold had a solid week, ending above $1,210, while oil continued its fall into 2015, ending the week below $50 a barrel for the first time since May 2009.

It’s easy to panic based on the extreme low the Index hit for the week, but given the historic performance of the first week in the New Year, this is more a reflection of the decreased state of the market over the past couple months than a sudden crash that will remain. Expect the Index to moderately improve in the coming weeks, likely back to the numbers we were seeing before the holidays.

Summary:

- Deals fell to 10, the lowest level in a year.

- No brokered deals were announced for the second time in two weeks.

- No bought deals were announced for the third time in three weeks.

- Total dollars crashed to $2.2m, the lowest level in over a year.

- Average deal size dropped to $0.2m, the lowest level in over a year.

Major Financing Openings:

- Teras Resources Inc. (TSX-V:TRA) opened a $1.2 million offering on a best efforts basis.

- Yorbeau Resources Inc. (TSX:YRB.A) opened and subsequently closed a $0.34 million offering on a best efforts basis.

- Nomad Ventures Inc. (TSX-V:NMD) opened a $0.25 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 60 months.

- Equitas Resources Corp. (TSX-V:EQT) opened a $0.11 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 24 months.

Major Financing Closings:

- Toro Oil & Gas Ltd. (TSX-V:TOO) closed a $15 million offering underwritten by a syndicate led by Macquarie Capital Markets on a bought deal basis.

- Brazil Resources Inc. (TSX-V:BRI) closed a $4.07 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 60 months.

- Viscount Mining Corp. (TSX-V:VML) closed a $1.75 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 36 months.

- Los Andes Copper Ltd. (TSX-V:LA) closed a $1.45 million offering on a best efforts basis.