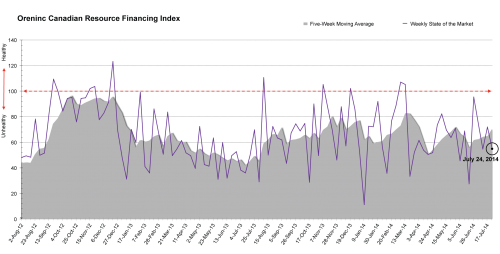

Oreninc Index Falls to Least Active Week Since January

The Oreninc Index fell for the week ending July 25, 2014. The main culprit for the drop was the number of deals announced, 18, a 28-week low. Total dollars announced fell to $101.5m, a two-week low. Five brokered deals were announced for $77.1m, also a two-week low; one bought deal was announced for $13m, a two-week high. While total dollars are down, the decrease is dwarfed by the drop in the number of deals announced, resulting in an average deal size of $5.64m, a six-week high that ranks this week as the third highest of 2014 for deal size.

Deal making seems to have cooled along with the private placement activity, giving us the impression that golf courses and swimming pools were more active than board rooms this week. As we have been saying, this is prototypical of summer activity, but gives less credence to the idea that this summer has been better overall than last; at this point, it is becoming less and less true every week. We’ll see if the summer can finish off strong in August, giving the industry some confidence as it heads into fall, where both activity and expectations will likely be up, if not necessarily in equal amounts.

Summary:

- Deals announced crashed to 18, a 28-week low.

- Five brokered deals were announced for $77.1m, a two-week low.

- One bought deal was announced for $13m, a two-week high.

- Total dollars fell to $101.5m, a two-week low.

- Average deal size jumped to $5.6m, a six-week high.

Major Financing Openings:

- Pretium Resources Inc. (TSX:PVG) opened a $52.97 million offering underwritten by a syndicate led by Scotia Capital Inc. on a best efforts basis.

- Denison Mines Corp. (TSX:DML) opened a $13.04 million offering underwritten by a syndicate led by Dundee Securities Ltd. on a bought deal basis. The deal is expected to close on or about August 12, 2014.

- Camex Energy Corp. (TSX-V:CXE.H) opened a $11 million offering underwritten by a syndicate led by Delano Capital on a best efforts basis.

- Cassidy Gold Corp. (TSX-V:CDX) opened a $10.17 million offering on a best efforts basis.

Major Financing Closings:

- Oryx Petroleum Corporation Limited (TSX:OXC) closed a $64.13 million offering underwritten by a syndicate led by BMO Capital Markets on a best efforts basis.

- Terrace Energy Corp. (TSX-V:TZR) closed a $20.02 million offering underwritten by a syndicate led by Canaccord Genuity on a bought deal basis.

- Seabridge Gold Inc. (TSX:SEA) closed a $13.8 million offering underwritten by a syndicate led by Canaccord Genuity Corp. on a bought deal basis.

- Rubicon Minerals Corporation (TSX:RMX) closed a $12 million offering underwritten by a syndicate led by TD Securities on a bought deal basis.