ORENINC INDEX increases as the industry prepares for PDAC

ORENINC INDEX - Monday, March 5th 2018

North America’s leading junior mining finance data provider

ORENINC MINING DEAL CLUB

Access to high-quality, pre-vetted financing opportunities

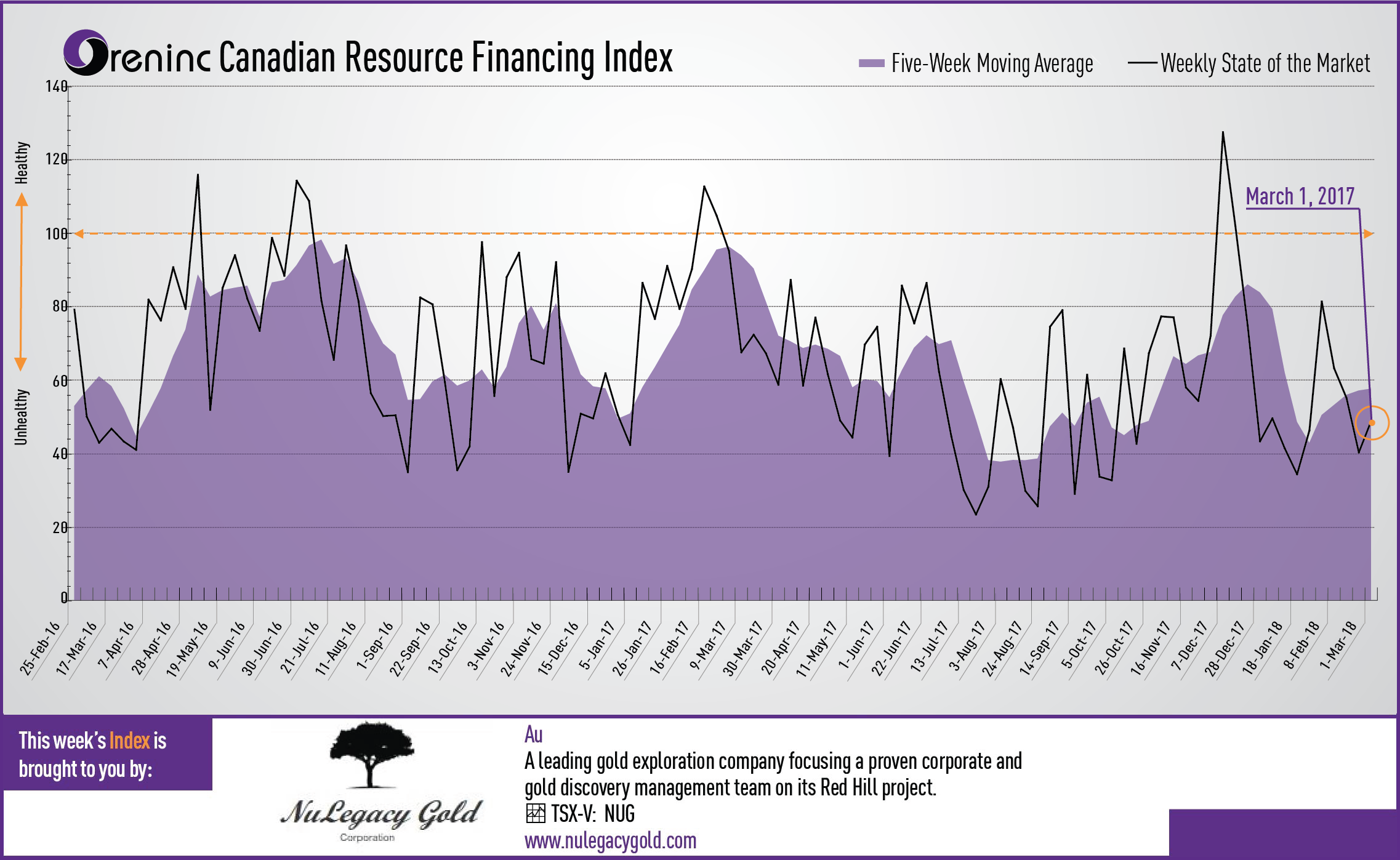

Last week index score: 40.31

This week: 41.06

The Oreninc Index increased in the week ending March 2nd, 2018 to 41.06 from 40.31 a week ago as financings announced bumped ahead of the PDAC (Prospectors and Developers Association Conference), the world’s largest mining conference, in Toronto, Canada, where the attendance is expected to be over 25,000 people.

Oreninc will make a presentation as part of the capital markets programme on Tuesday 6th at 08:45am in room 714, and has an exhibition booth #3010 in the Investors Exchange so come for a chance to win a bottle of Monkey 47 gin from Germany’s Black Forest. But also learn about the Oreninc Mining Deal Club.

Volatility continued as US president Donald Trump announced his intent to implement anti-dumping protection measures against steel imports of up to 25% and against aluminium of up to 10%. The US imports steel from over 100 countries. The news was met with dismay around the world with many countries stating that they are likely to implement safeguards of their own against US exports. The European Union, for one, is likely to implement targeted retaliation against specific US products such as Harley Davidson motorcylces and bourbon.

On to the money: total fund raises announced grew to C$133.7 million, a four-week high, which included three brokered financings for C$13.0, a seven-week high, and no bought-deal financings, an eight-week low. The average offer size jumped to C$4.8 million, a three-week high, whilst the total number of financings more than doubled to 28, a four-week high.

Of note, Lundin Gold (TSX:LUG) raised US$400 million (C$508 million) to complete the fund raising it needs to complete the build-out of the Fruta del Norte gold mine in Ecuador. However, the size of this financing means that it is an outlier as far as the Oreninc Index is concerned.

Gold fell to US$1,322/oz from US$1,328/oz a week ago having recovered from a mid-week low of US$1,317/oz after new US Federal Reserve chairman Jerome Powell told the House of Representatives' Financial Services Committee that the US economy had strengthened recently and took a hawkish stance during the Q&A. This saw gold threaten to fall below the US$1,300/oz level as the US dollar strengthen. It grew back to healthier levels at the end of the week as the US dollar weakened after Trumps steel duties were announced. The van Eck managed GDXJ closed down at US$31.73 from US$31.91 last week and the index is down 7.03% so far in 2018. The US Global Go Gold ETF closed up at US$12.47 from US$12.31 a week ago and is down 4.16% so far in 2018. The SPDR GLD ETF continued to see inflows to close at 833.98 tonnes from 829.26 a week ago.

In other commodities, silver closed down slightly at US$16.52/oz from US$16.53/oz a week ago. Copper had a losing week to close down at US$3.12/lb from US$3.23/lb. Oil broke its winning streak with WTI closing down at US$61.25 a barrel from US$63.55 a barrel a week ago.

After posting strong gains at the start of the week the Dow Jones Industrial Average took a plunge after Trump’s steel announcement to close down at 24,538 from 25,309 last week. Likewise, with Canada’s S&P/TSX Composite Index that closed down at 15,384 from 15,638 the previous week. The S&P/TSX Venture Composite Index closed down a smidge at 826.06 from 826.09 from 830.17 last week.

Oreninc CEO Kai Hoffmann was also a guest on Justin Hayek’s latest episode of “Car-Ride Confessions of a CEO” that can be viewed here:

http://oreninc.com/orenthink/entry/oreninc-ceo-kai-hoffmann-joins-justin-hayek-on-car-ride-confessions-of-a-ceo

Summary:

· Number of financings more than doubled to 27, a four-week high.

· Three brokered financings were announced this week for C$13.0m, a seven-week low.

· No bought-deal financing was announced this week, an eight-week low.

· Total dollars flew up to C$70.2m, a two-week high.

· Average offer size stayed near flat at C$2.6m, a five-week low.

Financing Highlights

Almadex Minerals (TSXV: AMZ) a non-brokered private placement on a strategic deal basis with Australia’s Newcrest Mining (ASX: NCM) of C$19.1 million

· 14.0 million shares @ C$1.36

· Newcrest will hold 19.9% of the El Cobre Au-Cu porphyry project in Veracruz. Mexico and will have no ownership interest in the spin out company.

· Almadex recently announced a strategic reorganization of its business with its early stage exploration projects, royalty interests and other non-core assets to be transferred into a spinout company

· Almadex also announced a non-brokered private placement financing up to 4.0 million units @ C$1.40 for C$5.6 million

· Each unit consists of one share and half a warrant exerciseable @ C$2.00 for two years.

· Net proceeds will be used to continue drilling the El Cobre Au/Cu porphyry targets in Veracruz, Mexico.

Major Financing Openings:

· Almadex Minerals (TSXV:AMZ) opened a C$19.07 million offering on a strategic deal basis.

· Watusi Capital (TSXV:WAS.H) opened a C$7.7 million offering on a best efforts basis.

· GT Gold (TSXV:GT) opened a C$6.5 million offering on a best efforts basis.

Major Financing Closings:

· eCobalt Solutions (TSX:ECS) closed a C$29.9 million offering underwritten by a syndicate led by TD Securities on a bought deal basis. Each unit included half a warrant that expires in 18 months.

· Filo Mining (TSXV:FIL) closed a C$15.3 million offering underwritten by a syndicate led by Haywood Securities on a bought deal basis.

· Bonterra Resources (TSXV:BTR) closed a C$11.52 million offering underwritten by a syndicate led by Sprott Capital Partners on a best efforts basis.

· Rubicon Minerals (TSX:RMX) closed a C$10.89 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis.