ORENINC INDEX falls as activity weakens

ORENINC INDEX - Monday, November 27th, 2017

North America’s leading junior mining finance data provider

Follow us on facebook and find us on Twitter @Oreninc

Last week index score: 55.59

This week: 54.36

LiCo Energy Metals (TSXV:LIC) received C$600,000 from a non-brokered private placement.

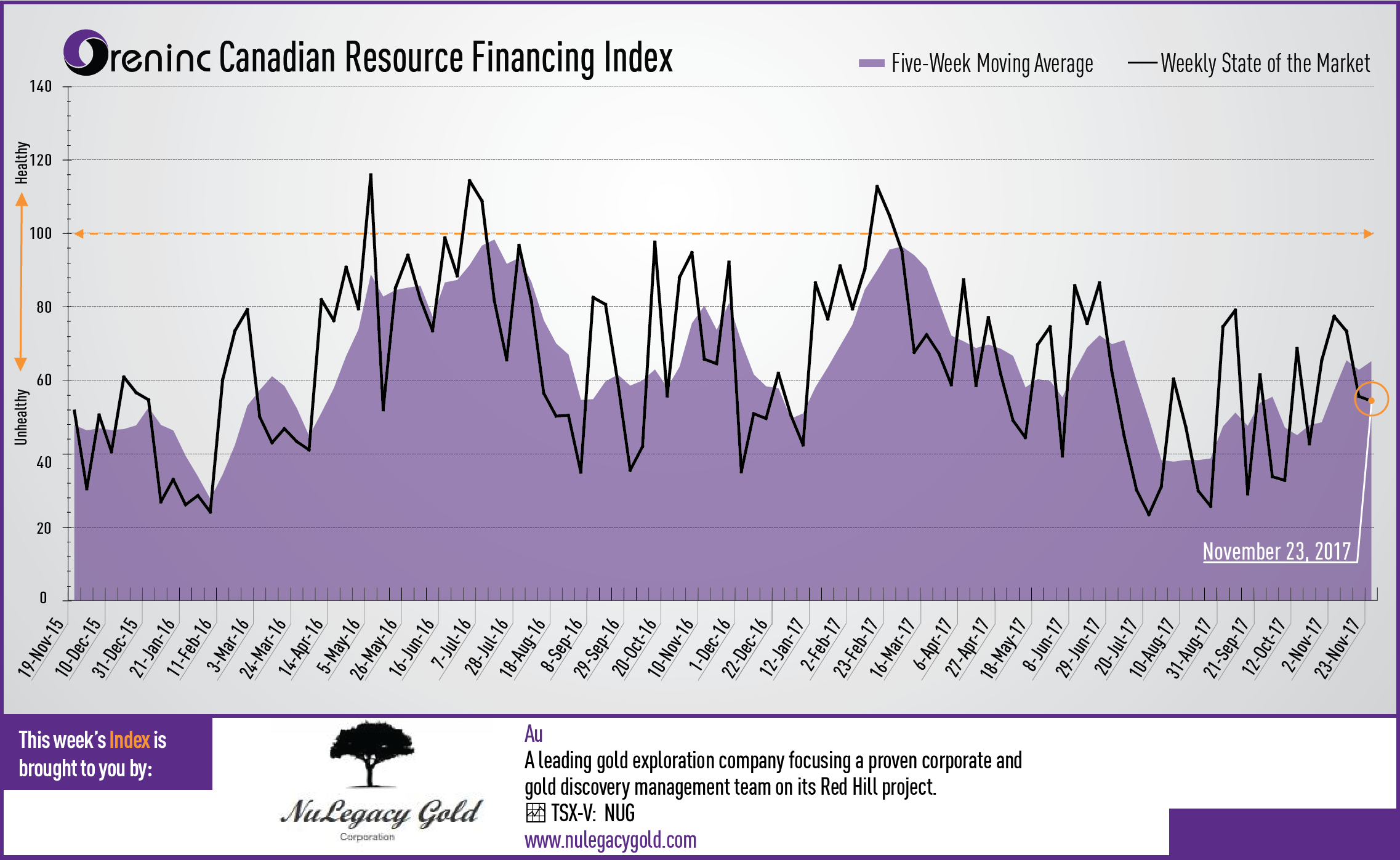

The Oreninc Index fell in the week ending November 24th, 2017 to 54.36 from 55.59 as financings experienced a slow week, possibly due to the US Thanksgiving holiday.

Gold prices increased last week with a softer US dollar ahead of the release of the minutes from the last US Federal Reserve meeting, where it kept interest rates unchanged. Citi bank released a report stated that the geopolitical case for gold investment has increased in recent months with prices likely to be buoyed by the "new normal" of elevated geopolitical tensions over the coming years. Citi analysts forecast that gold will "push north of US$1,400/oz for sustained periods" through to 2020.

That said, it was another relatively week on the geopolitical front that saw a peaceful change of ruler in Zimbabwe as 93-year old president Robert Mugabe stepped aside after 37 years in power and president Emmerson Mnangagwa was sworn in.

In Europe, negotiations of the UK’s exit from the European Union are reaching a crucial make-or-break moment, with many commentators opining that the lack of progress and unrealistic negotiating posture of the UK means that a hard exit will occur, that will see future trade relations be governed by standard WTO most-favoured nation tariffs. The Republic of Ireland is now weighing-in on the action declaring that it will veto any move that does not guarantee a free and open border with Northern Ireland. Looking ahead to how this will play out. One could paraphrase the truism about how one creates a small fortune in mining.

Total fund raises announced decreased again to C$139.8 million, a three-week low, which included two brokered financing for C$5.4 million, a two-week high, and no bought-deal financings, a seven-week low. The average offer size fell slightly to C$4.0 million, a three-week low, whilst the total number of financings announced decreased to 35, a two-week low.

Gold had an up-and-down week, losing a little ground to close at US$1,290/oz from US$1,292/oz a week ago. Gold is now up 12.6% since the start of the year. The van Eck managed GDXJ followed suit and closed down at US$32.18 from US$32.40 a week ago. It is now up 2.0% so far in 2017. The US Global Go Gold ETF showed a similar chart to close at US$12.44 from US$12.48 last week. The SPDR GLD ETF saw inventories remain the same at 843 tonnes as they were a week ago.

In other commodities, silver lost ground though it managed to remain above the US$17/oz mark to close at US$17.12/oz from US$17.31/oz a week ago. Copper had a strong week to close at US$3.15/lb from US$3.09/lb last week. Oil posted a similar chart to copper as it closed up at US$58.54 a barrel down from US$56.55 a week ago.

The Dow Jones Industrial Average returned to growth to close at 23,557 from 23,358 last week. Canada’s S&P/TSX Composite Index climbed back over 16,000 to close at 16,108 from 15,998 the previous week. The S&P/TSX Venture Composite Index slipped to close at 794.08 from 799.35 the previous week.

Summary:

- Number of financings decreased to 35, a two-week low.

- Two brokered financings were announced this week for C$5.4m, a two-week high.

- No bought-deal financings were announced this week, a seven-week low.

- Total dollars fell to C$139.8m, a three-week low.

- Average offer size also fell to C$4.0m, a three-week low.

Financing Highlights

Itafos (TSXV:IFOS) opened a C$96 million offering on a best efforts basis. The deal is expected to close on or about December 12th.

- Issuance of 45.7 million shares @ C$2.10

- Zaff, a company insider that owns or controls 60.78% of the company agreed to purchase its pro rata portion of the offering.

- Funds will be used to fund acquisitions and provide working capital.

- Italfos has signed a purchase agreement with Agrium (TSX:AGU) to acquire its Conda phosphate operations in Idaho, USA, an integrated producer of phosphate fertilizers and specialty products, for total US$100 million.

- Conda produces about 540,000tpy of mono-ammonium phosphate, super phosphoric acid, merchant grade phosphoric acid and specialty products.

Major Financing Openings:

- Itafos (TSXV:IFOS) opened a C$96 million offering on a best efforts basis. The deal is expected to close on or about December 12th.

- Red Eagle Mining (TSX:R) opened a C$8.24 million offering on a best efforts basis. Each unit includes a warrant that expires in 57 months.

- Argentina Lithium & Energy (TSXV:LIT) opened a C$3.3 million offering on a best efforts basis. Each unit includes a warrant that expires in 12 months.

- Montego Resources (CSE:MY) opened a C$3 million offering on a best efforts basis. Each unit includes a warrant that expires in 12 months.

Major Financing Closings:

- Neo Lithium (TSXV:NLC) closed a C$30.04 million offering underwritten by a syndicate led by Cormark Securities on a bought deal basis.

- Millennial Lithium (TSXV:ML) closed a C$30 million offering on a strategic deal basis.

- Cardinal Resources (TSX:CDV) closed a C$12 million offering underwritten by a syndicate led by Clarus Securities on a bought deal basis.

- Consolidated Westview Resource (C:CWS.H) closed a C$5.12 million offering on a best efforts basis.

Company news

LiCo Energy Metals (TSXV:LIC) received C$600,000 from a non-brokered private placement.

- 8.0 million share purchase warrants @ C$0.075.

- The company is seeking to raise up to C$960,000 via 8.0 million flow‐through units and up to 4.0 million non flow‐through units @ C$0.08. Each unit is comprised of one share and one warrant exercisable @ C$0.10 for two years.

- The proceeds will be used to advance its Teledyne and Glencore Bucke Properties, in Cobalt Ontario, Canada.