ORENINC INDEX - Monday, August 29th, 2022

North America’s leading junior mining finance data provider

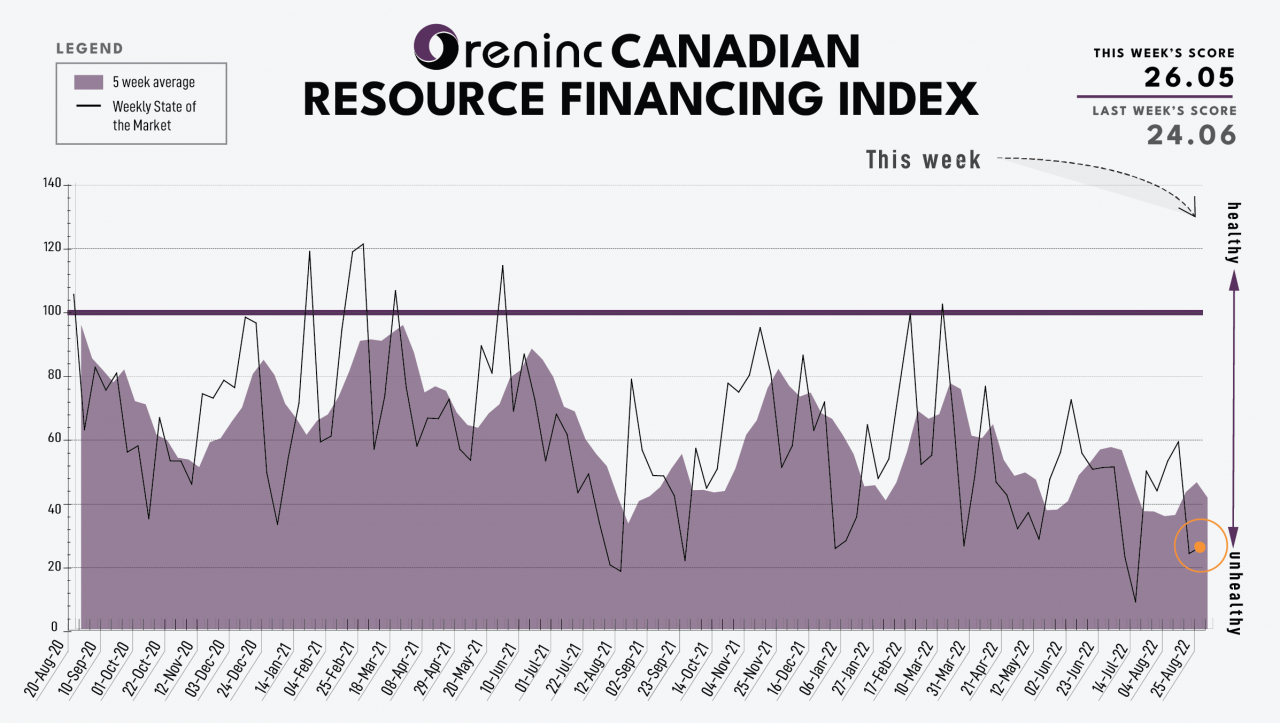

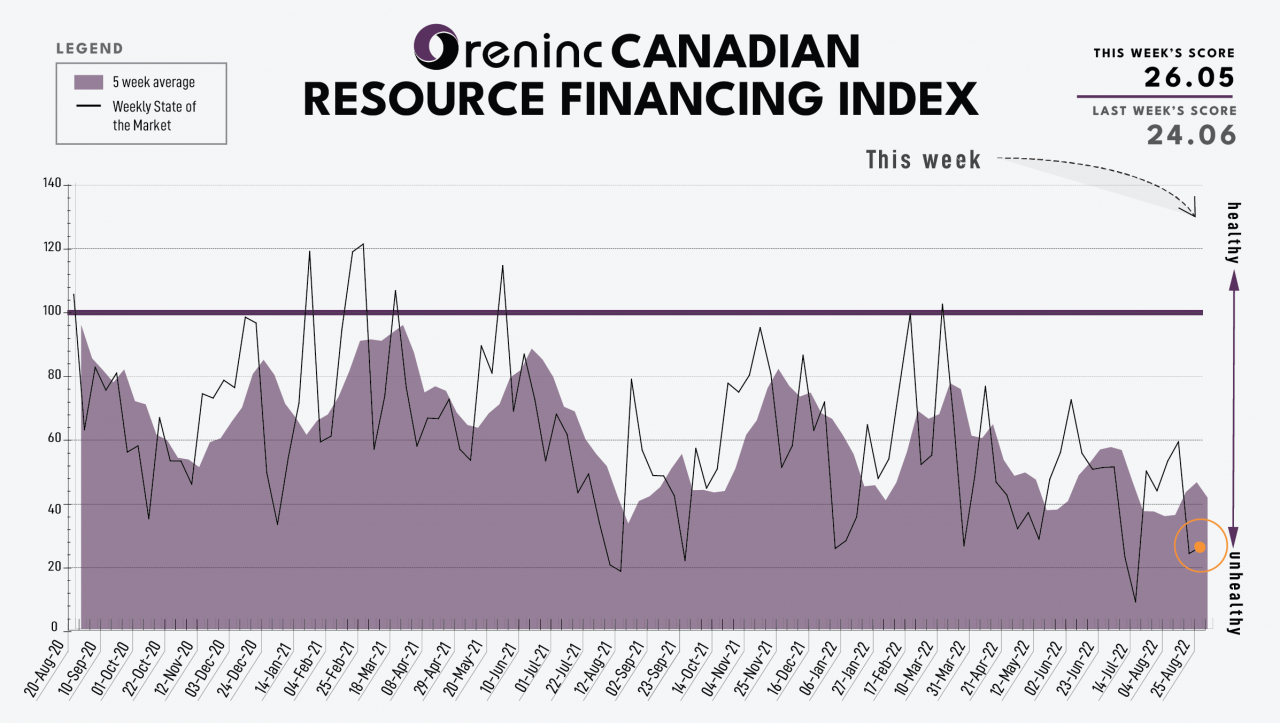

Last Week: 24.06

This week: 26.05

The Oreninc Index increased in the trading week ending August...

ORENINC INDEX - Monday, August 29th, 2022

North America’s leading junior mining finance data provider

Last Week: 24.06

This week: 26.05

The Oreninc Index increased in the trading week ending August...

2194 Views

Index updates, Top 10 financings, Presentations, Partner updates and much more …

ORENINC INDEX - Monday, August 29th, 2022

North America’s leading junior mining finance data provider

Last Week: 24.06

This week: 26.05

The Oreninc Index increased in the trading week ending August...

ORENINC INDEX - Monday, August 29th, 2022

North America’s leading junior mining finance data provider

Last Week: 24.06

This week: 26.05

The Oreninc Index increased in the trading week ending August... ORENINC INDEX - Monday, August 8th, 2022

North America’s leading junior mining finance data provider

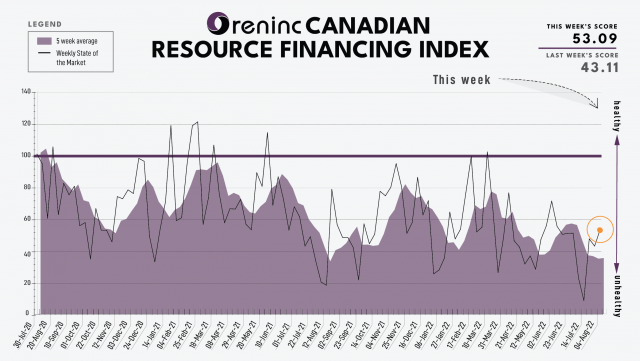

Last Week: 43.11

This week: 53.09

The Oreninc Index increased in the trading week ending August...

ORENINC INDEX - Monday, August 8th, 2022

North America’s leading junior mining finance data provider

Last Week: 43.11

This week: 53.09

The Oreninc Index increased in the trading week ending August... ORENINC INDEX - Monday, July 25th, 2022

North America’s leading junior mining finance data provider

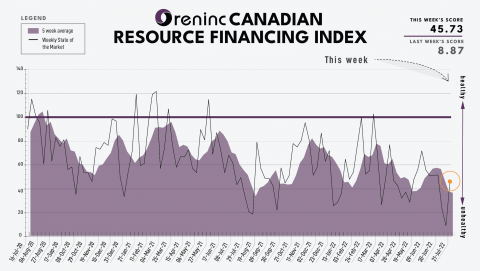

Last Week: 8.87

This week: 45.73

The Oreninc Index increased in the trading...

ORENINC INDEX - Monday, July 25th, 2022

North America’s leading junior mining finance data provider

Last Week: 8.87

This week: 45.73

The Oreninc Index increased in the trading... ORENINC INDEX - Monday, July 18th, 2022

North America’s leading junior mining finance data provider

Last Week: 23.06

This week: 8.87

The Oreninc Index decreased in the trading week ending July 15th, 2022...

ORENINC INDEX - Monday, July 18th, 2022

North America’s leading junior mining finance data provider

Last Week: 23.06

This week: 8.87

The Oreninc Index decreased in the trading week ending July 15th, 2022... ORENINC INDEX - Monday, April 18th 2022

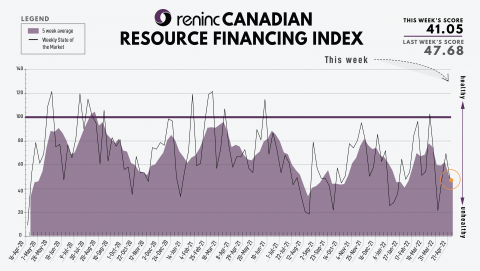

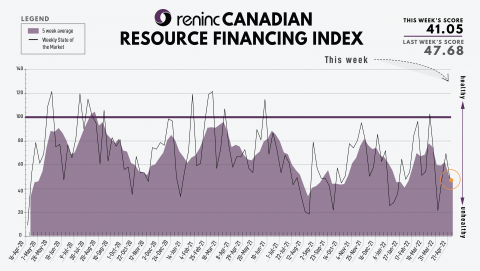

North America’s leading junior mining finance data provider

Last Week: 47.68

This week: 41.05

The Oreninc Index decreased in the trading week ending April...

ORENINC INDEX - Monday, April 18th 2022

North America’s leading junior mining finance data provider

Last Week: 47.68

This week: 41.05

The Oreninc Index decreased in the trading week ending April... ORENINC INDEX - Monday, April 18th 2022

North America’s leading junior mining finance data provider

Last Week: 47.68

This week: 41.05

The Oreninc Index decreased in the trading week ending April...

ORENINC INDEX - Monday, April 18th 2022

North America’s leading junior mining finance data provider

Last Week: 47.68

This week: 41.05

The Oreninc Index decreased in the trading week ending April... ORENINC INDEX - Monday, April 18th 2022

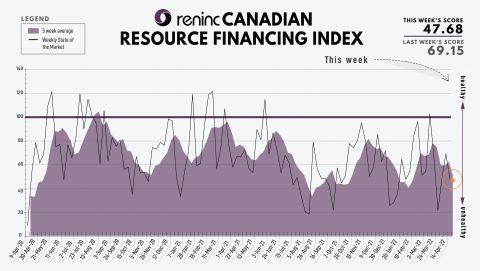

North America’s leading junior mining finance data provider

Last Week: 69.15

This week: 47.68

The Oreninc Index decreased in the trading week ending March...

ORENINC INDEX - Monday, April 18th 2022

North America’s leading junior mining finance data provider

Last Week: 69.15

This week: 47.68

The Oreninc Index decreased in the trading week ending March... ORENINC INDEX - Monday, March 21st 2022

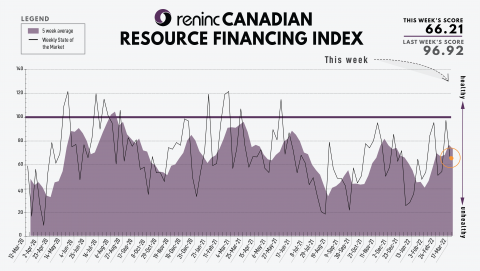

North America’s leading junior mining finance data provider

Last Week: 96.92

This week: 66.21

The Oreninc Index decreased in the trading week ending March 18th, 2022...

ORENINC INDEX - Monday, March 21st 2022

North America’s leading junior mining finance data provider

Last Week: 96.92

This week: 66.21

The Oreninc Index decreased in the trading week ending March 18th, 2022... ORENINC INDEX - Monday, March 7th 2022

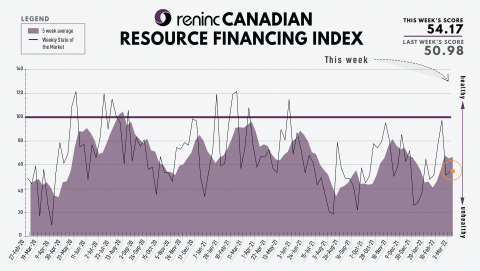

North America’s leading junior mining finance data provider

Last Week: 50.98

This week: 54.17

The Oreninc Index increased in the trading week ending March 4th, 2022...

ORENINC INDEX - Monday, March 7th 2022

North America’s leading junior mining finance data provider

Last Week: 50.98

This week: 54.17

The Oreninc Index increased in the trading week ending March 4th, 2022... ORENINC INDEX - Monday, February 14th 2022

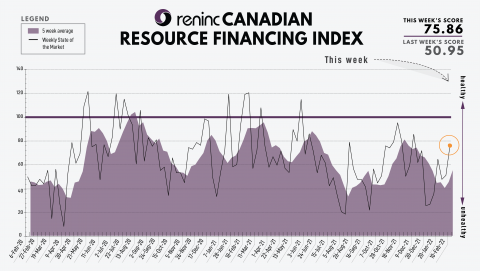

North America’s leading junior mining finance data provider

Last Week: 50.95 (Updated)

This week: 75.86

The Oreninc Index increased in the trading week ending...

ORENINC INDEX - Monday, February 14th 2022

North America’s leading junior mining finance data provider

Last Week: 50.95 (Updated)

This week: 75.86

The Oreninc Index increased in the trading week ending...