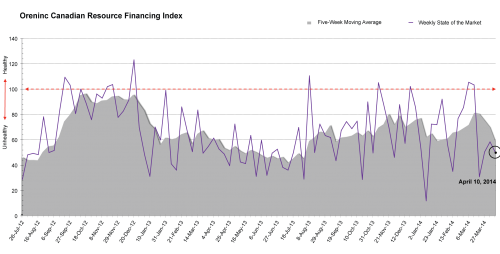

Oreninc Index Update: April 10, 2014

Oreninc Index Falls As Total Dollars Announced Rises

The Oreninc Index fell to a three-week low even while total dollars announced increased during the week ending April 10, 2014. Total dollars announced increased to a four-week high; brokered and bought deal dollars raised also climbed to four-week highs. On the downside, the five-week moving average fell to its lowest level since September 2013. The markets are down from the start of the year, but remain at higher levels than 2013.

Summary:

- Deals announced fell to 22, an eight-week low.

- Three brokered deals were announced for $46.8m, a four-week high.

- Two bought deals were announced for $44.8m, a four-week high.

- Total dollars announced rose to $86.2m, a four-week high.

- Average deal size more than doubled to $3.9m, a four-week high.

Major Financing Openings:

- Teranga Gold Corporation (TSX:TGZ) opened a $29.9 million offering underwritten by a syndicate led by Cormark Securities Inc. on a bought deal basis. The deal is expected to close on or about May 1, 2014.

- Sahara Energy Ltd. (TSX-V:SAH) opened a $15.6 million strategic deal. The offering is expected to close on or about June 30, 2014.

- Marquee Energy Ltd. (TSX-V:MQL) opened a $15 million offering underwritten by a syndicate led by National Bank Financial Inc. on a bought deal basis. The deal is expected to close on or about May 2, 2014.

- West Kirkland Mining Inc. (TSX-V:WKM) opened a $5.1 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 60 months.

Major Financing Closings:

- Taipan Resources Inc. (TSX-V:TPN) closed a $6.48 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 48 months.

- WCB Resources Ltd. (TSX-V:WCB) closed a $6 million offering on a strategic deal basis. Each unit includes 1 warrant that expires in 36 months.

- Cornerstone Capital Resources Inc. (TSX-V:CGP) closed a $4 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 60 months.

- Red Eagle Mining Corporation (TSX-V:RD) closed a $5 million offering underwritten by a syndicate led by Haywood Securities on a bought deal basis.

Comments