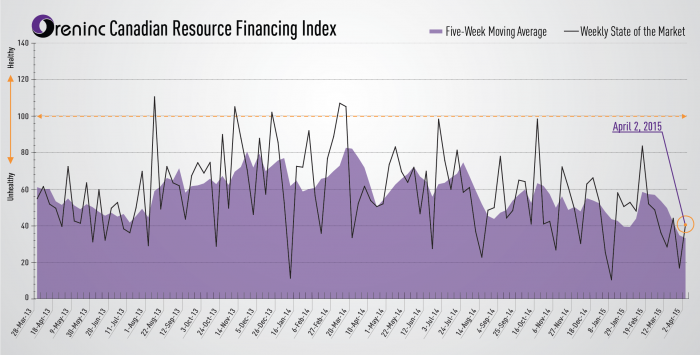

Oreninc Index Update: April 2, 2015

Oreninc Index Crawls Back Up

The Oreninc Index crawled back up for the week ending April 2, 2015. Total dollars announced rose to $38.3m on 23 deals, three and five week highs respectively. Two brokered financings were announced for $17.4m, one of which has yet to announce an offer size, a two-week high. One bought deal was announced for $17.4m, a two-week high.

The only major deal from the week was Israel Chemicals Ltd. (NYSE:ICL) agreeing to purchase Allana Potash Corp. (TSX:AAA) for $137m CDN. Commodities had a roller coaster of a week, with iron ore dropping 15% in just one week and gold moving up and down before settling right around $1,200. Oil was down slightly on news that a framework of an Iranian nuclear deal had been achieved, though it did not drop as much as analysts had been expecting.

While not great, seeing an improvement over last week’s horrendous performance is a positive, even if the five-week moving average plunged further than last week’s multi-year low.

Summary:

- Number of financings jumped to 23, a five-week high.

- Two brokered financings were announced for $17.4m, one of which has yet to announce an offer size, a two-week high.

- One bought deal financings was announced for $17.4m, a two-week high.

- Total dollars increased to $38.3m, a three-week high.

- Average offer rose to $1.7m, a two-week high.

Major Financing Openings:

- Fission Uranium Corp. (TSX-V:FCU) opened a $17.4 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis. The deal is expected to close on or about April 29, 2015.

- Marlin Gold Mining Ltd. (TSX-V:MLN) opened a $8.75 million offering on a strategic deal basis, along with a brokered offering for a yet-to-be-determined amount. The deals are expected to close on or about April 21, 2015.

- Kivalliq Energy Corporation (TSX-V:KIV) opened a $2.7 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months. The deal is expected to close on or about April 28, 2015.

- Petrolympic Ltd. (TSX-V:PCQ) opened a $2 million offering on a best efforts basis.

Major Financing Closings:

- Mountain Province Diamonds Inc. (TSX:MPV) closed a $95.05 million offering on a best efforts basis.

- Red Eagle Mining Corporation (TSX-V:RD) closed a $4.83 million offering on a strategic deal basis.

- Aquila Resources Inc. (TSX:AQA) closed a $4.31 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 36 months.

- Africa Energy Corp. (TSX-V:AFE) closed a $4.22 million offering on a best efforts basis.

Comments

Multi-year low. The pain intensifies. For the contrarian, ripe pickings of low hanging fruit.