Oreninc Index Update: August 21, 2014

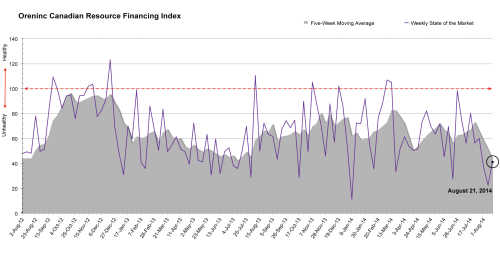

Oreninc Index Rises but Remains in Late Summer Slump

The Oreninc Index rose, but remained fully entrenched in the depths of a summer slump for the week ending August 21, 2014. While it increased a decent margin from the week before, this marks week three of the worst three-week stretch of the past few years. Total dollars jumped to $67.6m, a four-week high. Four brokered deals were announced for $18.5m, a three-week high; one bought deal was announced for $12.5m, a four-week high.

The biggest news of the week came with BHP announcing their intentions to spin off non-core assets into a new company that will be run independently (100% of the shares of the new company will be distributed to their current shareholders). BHP says they are demerging assets that they consider not part of the future of their core business (many of these are operations gained in the 2001 merger). Shares fell 5% on the news. Gold prices hit a two-month low after the United States Federal Reserve’s July meeting minutes indicated that the organization was slightly more likely to increase interest rates if the economy continued to gain strength. The TSX-V composite index did rise marginally this week, though junior miner North American Nickel (TSX-V:NAN) fell 40% on news of their summer drill results.

While the Oreninc Index’s numbers are certainly disappointing, Labour Day can be seen in the distance, and with it the promise of bankers back at their desks and companies back trying to raise money. The question is whether this unusually poor August is just part of a lazy summer or a sign of an equally disturbing September to come.

Summary:

- Deals announced rose to 25, a three-week high.

- Four brokered deals were announced for $18.5m, a three-week high.

- One bought deal was announced $12.5m, a four-week high.

- Total dollars jumped to $67.6m, a four-week high.

- Average deal size increased to $2.7m, a four-week high.

Major Financing Openings:

- EMED Mining Public Ltd. (TSX-V:EMD) opened a $23.91 million offering on a strategic deal basis.

- Fission Uranium Corp. (TSX-V:FCU) opened a $12.53 million offering underwritten by a syndicate led by Dundee Securities Ltd. on a bought deal basis. The deal is expected to close on or about September 23, 2014.

- GB Minerals Ltd. (TSX-V:GBL) opened a $10.23 million offering on a best efforts basis.

- NuLegacy Gold Corporation (TSX-V:NUG) opened a $3.53 million offering on a strategic deal basis.

Major Financing Closings:

- Corsa Coal Corp. (TSX-V:CSO) closed a $78.08 million offering on a best efforts basis.

- Sahara Energy Ltd. (TSX-V:SAH) closed a $16.2 million offering on a strategic deal basis.

- Silver Bear Resources Inc. (TSX:SBR) closed a $10.95 million offering on a best efforts basis.

- Canadian Overseas Petroleum Ltd. (TSX-V:XOP) closed a $10.11 million offering underwritten by a syndicate led by GMP Securities L.P. on a best efforts basis.

Comments