Oreninc Index Update: December 4th, 2017

ORENINC INDEX gains despite less dollars being raised

ORENINC INDEX - Monday, December 4th, 2017

North America’s leading junior mining finance data provider

Follow us on facebook and find us on Twitter @Oreninc

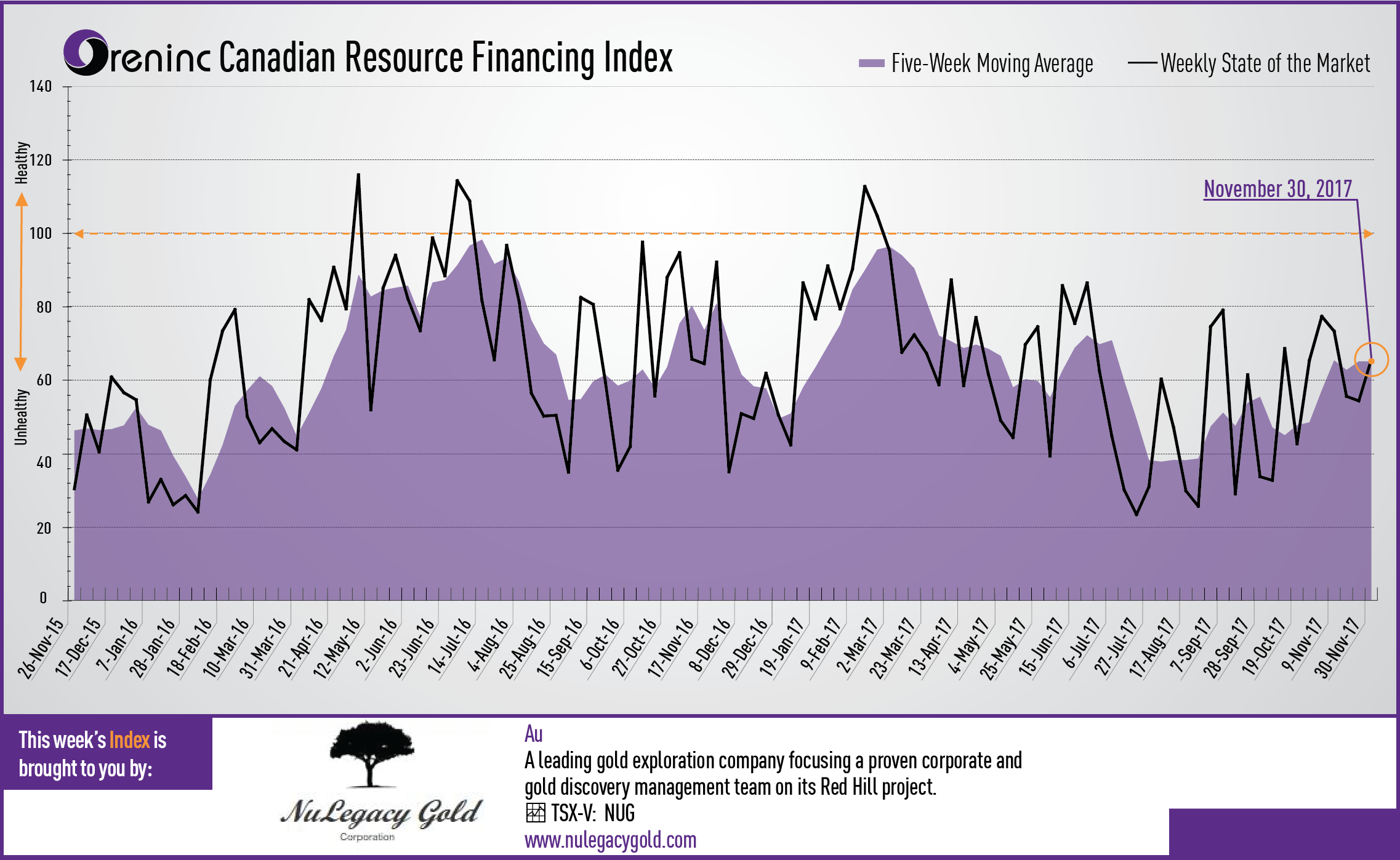

Last week index score: 54.36

This week: 65.53

NuLegacy Gold (TSXV:NUG) appointed Charles Weakly as district geologist.

LiCo Energy Metals (TSXV: LIC) reported drill results from the recently completed program on the Glencore Bucke Property in Cobalt, Ontario, Canada.

Zinc One Resources (TSXV:Z) reported that Nubian Resources completed due diligence to acquire the Esquilache silver-lead-zinc project from the company.

Castle Silver Resources (TSXV) reported that ongoing underground sampling returned high-grade cobalt from additional areas at the Castle mine near Gowganda, Ontario, Canada.

The Oreninc Index climbed in the week ending December 1st, 2017 to 65.53 from 54.36 due to an increase in brokered financings and overall financings although the amount sought declined.

Gold experienced another week of unfulfilled promises. After starting strongly and approaching the US$1,300/oz mark on Monday, it saw three consecutive days of losses before recovering Friday to end the week at US$1,280/oz as the US economy continued to strengthen. Mid-week, the US Commerce Department said that the GDP estimate for the third quarter showed the US economy expand by 3.3%, up from a first estimate of 3.0%.

US president Donald Trump looks like he has obtained the first major legislative achievement of his administration as the Senate passed the tax reform bill. This will be the first major tax shakeup in the US in some thirty years, since 1986, with US$1.4T in tax cuts coming, which is likely to be negative for gold.

Total fund raises announced decreased again to C$98.5 million, a six-week low, which included three brokered financing for C$13.0 million, a three-week high, and one bought-deal financing for C$6.0 million, a three-week high. The average offer size fell by more than half to C$1.9 million, a six-week low, whilst the total number of financings announced increased to 51, a 34-week high.

Gold had a losing week to close at US$1,280/oz from US$1,288/oz a week ago. Gold is now up 11.6% since the start of the year. The van Eck managed GDXJ followed suit and closed down at US$31.75 from US$32.18 from. It is now up .6% so far in 2017. The US Global Go Gold ETF showed a similar chart to close at US$12.27 from US$12.44 last week. The SPDR GLD ETF added to inventories to close at 848 tonnes from 843 tonnes a week ago.

In other commodities, silver took a beating to close at US$16.44 from US$17.05/oz a week ago. Copper also took a hit to close at US3.09/lb from US$3.19/lb last week. Oil slipped a little to close down at US$58.36 a barrel from US$58.95 a barrel a week ago despite ministers from OPEC member states and Russia agreeing to extend the current output cuts until the end of 2018.

Following a flat week, the Dow Jones Industrial Average received a big boost as the week ended to close at 24,231 from 23,557 last week. Canada’s S&P/TSX Composite Index slipped to close at 16,038 from 16,108 the previous week. The S&P/TSX Venture Composite Index slipped to close at 789.00 from 794.01 the previous week.

Summary:

- Number of financings grew to 51, a 34-week high.

- Three brokered financings were announced this week for C$13.0m, a three-week high.

- One bought-deal financing was announced this week for C$6m, a three-week high.

- Total dollars decreased to C$98.5m, a six-week low.

- Average offer size dropped to C$1.9m, a six-week low.

Financing Highlights

New Pacific Metals (TSXV:NUAG) opened a C$22.72 million offering on a strategic deal basis.

- Pan American Silver to take 16.0 million and Silvercorp Metals to take 3.0 million units @ C$1.42 per for gross proceeds of C$27.0 million.

- Each unit includes half a warrant that expires in 18 months.

- The proceeds will for exploration and/or development on its Silver Sand project in Potosí, Bolivia.

Reunion Gold (TSXV:RGD) opened a C$9.12 million offering on a strategic deal basis.

- Barrick Gold to purchase 48 million shares @ C$0.19 for gross proceeds of C$9.12 million.

- Barrick will own about 15% of Reunion.

- The proceeds will be used to fund exploration and development costs of Reunion’s gold exploration projects in French Guiana and Guyana.

- The deal is expected to close on or about November 30th.

Major Financing Openings:

- New Pacific Metals (TSXV:NUAG) opened a C$22.72 million offering on a strategic deal basis. Each unit includes half a warrant that expires in 18 months.

- Reunion Gold (TSXV:RGD) opened a C$9.12 million offering on a strategic deal basis. The deal is expected to close on or about November 30th.

- MGX Minerals (CSE:XMG) opened a C$7.5 million offering on a best efforts basis. Each unit includes a warrant that expires in 36 months. The deal is expected to close on or about December 4th.

- SilverCrest Metals (TSXV:SIL) opened a C$6 million offering underwritten by a syndicate led by National Bank Financial on a bought deal basis. Each unit includes half a warrant that expires in 24 months. The deal is expected to close on or about December 19th.

Major Financing Closings:

- Solgold (TSX:SOLG) closed a C$75.6 million offering underwritten by a syndicate led by National Bank Financial on a bought deal basis.

- MAG Silver (TSX:MAG) closed a C$61.58 million offering on a best efforts basis.

- Dalradian Resources (TSX:DNA) closed a C$50 million offering on a strategic deal basis with Orion Mine Finance.

- Dalradian Resources (TSX:DNA) closed a C$28.25 million offering on a strategic deal basis with Osisko Gold Royalties.

Company news

NuLegacy Gold (TSXV:NUG) appointed Charles Weakly as district geologist.

- Weakly to the discovery of over 10Moz Au for Barrick Gold in several deposits in the Goldstrike and Cortez districts. The Cortez district has three established multi-million-ounce deposits immediately north-west of NuLegacy's Red Hill gold property.

Analysis

Known in Nevada as the gold finder, adding Weakly to the NuLegacy geological team is a real coup for the company as it will bolster efforts to establish a multi-million-ounce resource at Red Hill.

Zinc One Resources (TSXV:Z) reported that Nubian Resources completed due diligence to acquire the Esquilache silver-lead-zinc project from the company.

- Esquilache is a former underground lead-zinc mine and adjacent Virgen de Chapi prospect in Puno, Peru.

- A definitive purchase agreement will be completed by December 22nd.

- Nubian advanced $25,000 to Zinc One reducing the cash amount owing on closing from $125,000 to $100,000, which amount will be in addition to the $475,000 in common shares due to the company.

- The project is subject to a 2% NSR.

Analysis

The sale of Esquilache provides Zinc One with additional financing with which to focus on the advancement of the Bongará and Charlotte Bongará projects in Peru.

Castle Silver Resources (TSXV) reported that ongoing underground sampling returned high-grade cobalt from additional areas at the Castle mine near Gowganda, Ontario, Canada.

- Highlights included 3.1% Co in sample CSR-UG-T-2

- Areas prospective for cobalt mineralization were highlighted through XRF analysis of the first level workings. Sampling is designed to gain a better understanding of the grade intensity and distribution in order to prioritize underground drill targets.

Analysis

Sampling is returning encouraging cobalt grades that supports the company’s thesis that past operators may have left much behind due to their focus on mining high-grade silver.

LiCo Energy Metals (TSXV: LIC) reported drill results from the recently completed program on the Glencore Bucke Property in Cobalt, Ontario, Canada.

- Highlights included 2.0, @ 1.11% Co, 16.6 ppm Ag in hole GB17-07

- On Glencore Bucke, LiCo has completed 21 diamond drill holes totaling 1,900m, testing the Main and Northwest zones.

- Drilling has confirmed and extended the cobalt mineralization with grades consistent with historical grades and widths.

Analysis

Drilling intersected cobalt style mineralization in every drill hole completed with four of the seven holes assayed to date returning grades of more than 1% cobalt as well as encouraging silver and copper results. LiCo has a good base for follow-up exploration in 2018.

LiCo also reported assay results for the first diamond drill hole at its Teledyne property at Cobalt, Ontario, Canada.

6.0m @ 0.62% Co in hole TE17‐01

11 diamond drill holes totaling 2,200m have been drilled at Teledyne

Analysis

The company is being successful replicating the historical drill results. The test for the company will be building upon these to expand and define a resource.

Comments