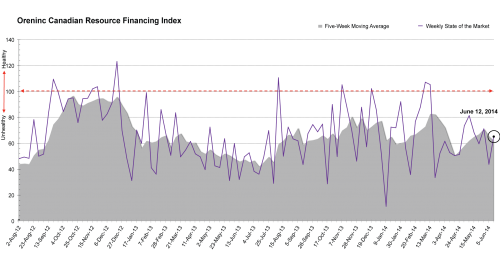

Oreninc Index Update: June 12, 2014

Oreninc Index Rebounds to Modest Levels

The Oreninc Index returned to modest levels for the week ending June 12, 2014. After last week’s dramatic fall, the Index has returned to the relatively optimistic numbers we had seen in previous weeks. Total dollars announced rose to $157.8m, a three-week high. Seven brokered and bought deals were announced for $77.9m, five-week highs. The most impressive statistic of the week was an average deal size of $5.63m, a 14-week high. This continues the ongoing narrative that spring 2014 has had more activity than 2013, and gives us hope of an uptick. The next few weeks will be telling as we head into the summer solstice and the official start of summer.

Summary:

- Deals announced dropped to 28, tied for a three-week low.

- Seven brokered deals were announced for $77.9m, a five-week high.

- Seven bought deals were announced for $77.9m, a five-week high.

- Total dollars announced rose to $157.8m, a two-week high.

- Average deal size improved to $5.6m, a 14-week high.

Major Financing Openings:

- Crocotta Energy Inc. (TSX:CTA) opened a $58.01 million offering underwritten by a syndicate led by National Bank Financial Inc. on a bought deal basis. The deal is expected to close in July 2014.

- Guyana Goldfields Inc. (TSX:GUY) opened a $44.4 million offering on a best efforts basis.

- Kirkland Lake Gold Inc. (TSX:KGI) opened a $7 million offering underwritten by a syndicate led by National Bank Financial Inc. on a bought deal basis. The deal is expected to close on or about July 3, 2014.

- Arsenal Energy Inc. (TSX:AEI) opened a $6.5 million offering underwritten by a syndicate led by Acumen Capital on a bought deal basis. The deal is expected to close on or about July 3, 2014.

Major Financing Closings:

- Ivanhoe Mines Ltd. (TSX:IVN) closed a $125 million offering on a strategic deal basis.

- Americas Petrogas Inc. (TSX-V:BOE) closed a $17.25 million offering underwritten by a syndicate led by Mackie Research Capital Corporation on a best efforts basis. Each unit includes a 1/2 warrant that expires in 36 months.

- Midway Gold Corp. (TSX-V:MDW) closed a $27.25 million offering underwritten by a syndicate led by RBC Capital Markets on a bought deal basis.

- Ascot Resources Ltd. (TSX-V:AOT) closed a $3.5 million offering on a best efforts basis.

Comments