Oreninc Index Update: November 13th, 2017

ORENINC INDEX falls although major deals announced

ORENINC INDEX - Monday, November 13th, 2017

North America’s leading junior mining finance data provider

ORENINC MINING DEAL CLUB

Access to high-quality, pre-vetted financing opportunities

www.miningdealclub.com

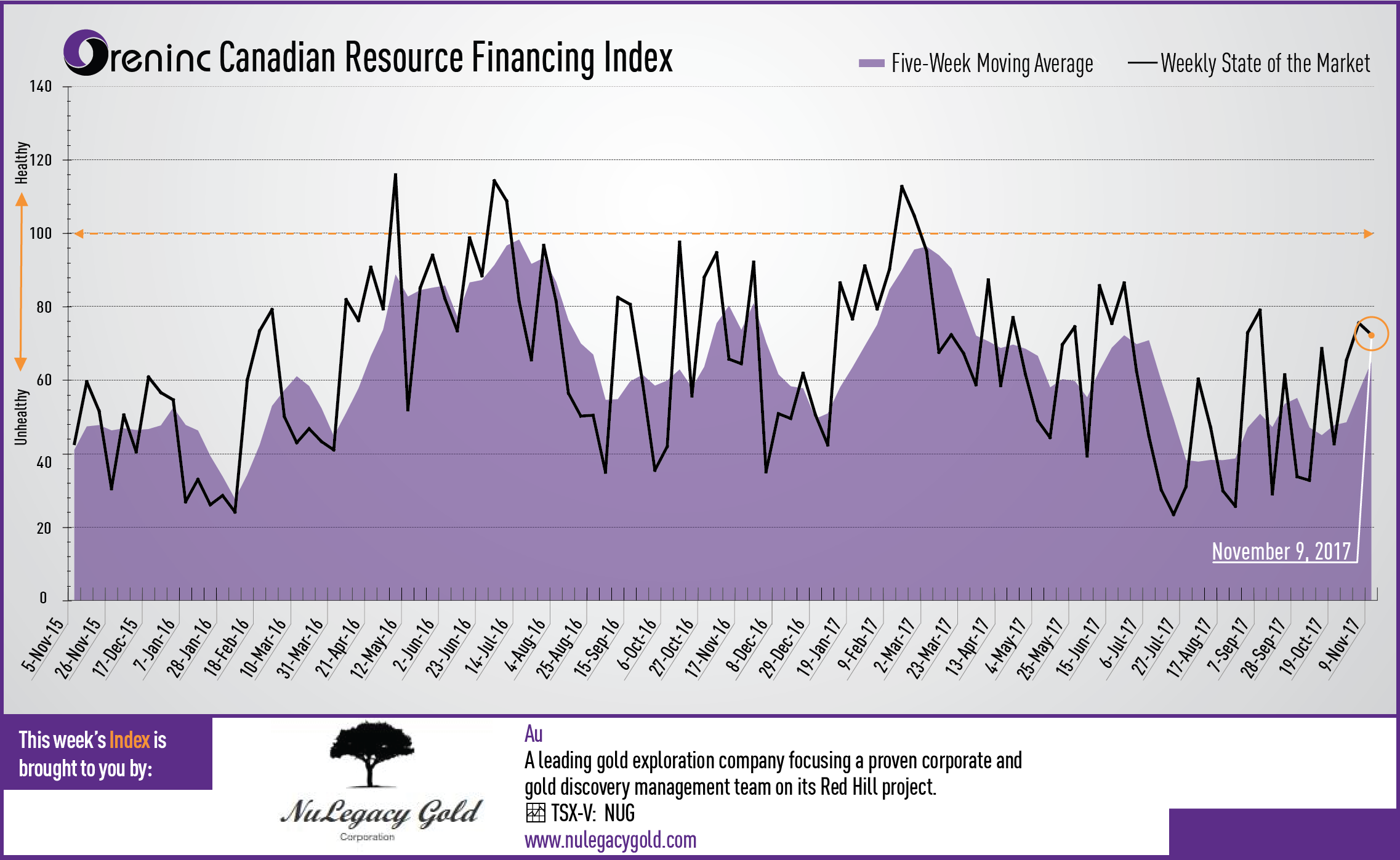

Last week index score: 75.58

This week: 72.44

LiCo Energy Metals (TSXV:LIC) reported assay results for the first five diamond drill holes from its on‐going drill program on the Glencore Bucke Property in Ontario, Canada.

Prospero Silver (TSXV:PSL) provided a preliminary update on the first-stage reconnaissance drilling of its Petate project in Hidalgo, Mexico.

The Oreninc Index fell slightly in the week ending November 10th, 2017 to 72.44 from 75.58 as the number of financings fell despite the amounts announced increasing.

The past week was very interesting from a geopolitical point of view. US president Donald Trump is engaged in a 12-day tour of Asia and whilst showing some restraint—and dare I say it, diplomacy—during his visit to China, he immediately followed this with a tirade at the Asia-Pacific Economic Co-operation (Apec) summit in Vietnam, at what he labelled “chronic trade abuses”. Trump set out an isolationist tone at the summit that contrasted starkly with the open cooperativeness of China’s leader Xi Jinping. Trump favours bilateral trade agreements rather than multilateral ones, as with one of two exceptions, US economic might means that its interests will always obtain the upper hand in bilateral agreements as the UK will find out in a little over a year if it does indeed leave the European Union.

In the Middle East, tensions are mounting as a power struggle between Saudi Arabia and Iran escalates—which can also be viewed as the Sunni cast of Islam against the Shia cast—as Crown Prince Mohammed bin Salman moves to consolidate his position and impose his vision for the future. This vision includes a clampdown on corruption on the domestic front where some 200-people including high-ranking officials were arrested, and now, seemingly going head-to-head with Iran following an attempted missile strike on Riyadh airport that bin Salman claimed was military aggression by Iran. The prices for both gold and oil have responded to events in the Middle East.

Total fund raises announced decreased slightly to C$146.6 million, a four-week high, which included five brokered financings for C$106.7 million, a 20-week high, and three bought-deal financings for C$89.7 million, a 34-week high. The average offer size doubled to C$4.9 million, a four-week high, whilst the total number of financings announced fell to 30, a three-week low.

Gold had another up-and-down week although it managed to close slightly higher at US$1,275/oz from US$1,269/oz a week ago. Gold is now up 11.1% since the start of the year. The van Eck managed GDXJ had a stagnant week, closing at US$32.11 from US$32.12 a week ago. It is now up 1.77% so far in 2017. The US Global Go Gold ETF fared slightly better to close at US$12.34 up from US$12.24 last week. The SPDR GLD ETF saw inventories continue to sell down to close the week at 843 tonnes from 846 tonnes a week ago.

In other commodities, silver had a volatile week moving either side of US$17/oz before closing at US$16.88/oz up from US$16.84/oz a week ago. Copper gad a weak week and giving up ground to close at US$3.07/lb from US$3.11/lb last week. Oil continued its surge upwards and closed the week at US$56.74 a barrel from US$55.64 a barrel a week ago.

The Dow Jones Industrial Average finally had a losing week but not before hitting a new record 23,563 mid-week, before it closed at 23,422 from 23,539 last week. Canada’s S&P/TSX Composite Index posted a similar growth chart to the Dow’s and hit a record 16,131 before closing at 16,039 up from 16,020 the previous week. The S&P/TSX Venture Composite Index saw more growth to close at 796.48 from 791.98 the previous week.

Summary:

- Number of financings decreased to 30, a three-week low.

- Five brokered financings were announced this week for C$106.7m, a 20-week high.

- Three bought-deal financings were announced this week for C$89.7, a 34-week high.

- Total dollars increased to C$146.6m, a four-week high.

- Average offer size doubled to C$4.9m, a four-week high.

Financing Highlights

Solgold (TSX:SOLG) opened a C$75.6 million offering underwritten by a syndicate led by National Bank Financial on a bought deal basis.

- 180 million shares @ £0.25.

- Net proceeds will be used for exploration and studies to advance its Cascabel project in northern Ecuador, where it has over ten drill rigs operating.

Lumina Gold (TSXV:LUM) opened a C$15 million offering underwritten by a syndicate led by Raymond James on a best efforts basis. The deal is expected to close on or about November 29th.

- Subsequently increased to C$20 million

- Up to 32.3 million shares @ C$0.62.

- Proceeds will be used for the exploration and advancement of Lumina’s projects in Ecuador including drilling at its Condor gold deposit and drilling at its Cangrejos deposit.

Major Financing Openings:

- Solgold (TSX:SOLG) opened a C$75.6 million offering underwritten by a syndicate led by National Bank Financial on a bought deal basis.

- Lumina Gold (TSXV:LUM) opened a C$15 million offering underwritten by a syndicate led by Raymond James on a best efforts basis. The deal is expected to close on or about November 29th.

- Aquila Resources (TSX:AQA) opened a C$12.78 million offering on a strategic deal basis. Each unit includes half a warrant that expires in 42 months.

- Northern Empire Resources (TSXV:NM) opened a C$10.08 million offering underwritten by a syndicate led by Cormark Securities on a bought deal basis. The deal is expected to close on or about November 28th.

Major Financing Closings:

- LSC Lithium (TSXV:LSC) closed a C$6 million offering underwritten by a syndicate led by GMP Securities on a best efforts basis. Each unit included half a warrant that expires in 36 months.

- Plateau Uranium (TSXV:PLU) closed a C$1.8 million offering on a best efforts basis. Each unit included half a warrant that expires in 18 months.

- Canada Zinc Metals (TSXV:CZX) closed a C$1.52 million offering on a best efforts basis.

- Aintree Resources (TSXV:AIN.H) closed a C$1.05 million offering on a best efforts basis.

Company news

LiCo Energy Metals (TSXV:LIC) reported assay results for the first five diamond drill holes from its on‐going drill program on the Glencore Bucke Property in Ontario, Canada.

- Highlights included 3.0m @ 0.31% Co in hole GB17‐01.

- 19 diamond drill holes totalling 1,565m have been completed on Glencore Bucketo date testing the Northwest and Main Zones.

- Drilling has confirmed and extended the cobalt mineralization on the property with grades that are consistent with historical grades and widths in the overall Cobalt Camp.

- A second drill testing the Teledyne property has completed four holes for 804m as LiCo works towards creating a geological model and NI 43‐101 complaint mineral resource estimate.

Analysis

Obtaining similar grade and widths as the historical mining is encouraging, particularly as the mineralization was intersected near surface.

Prospero Silver (TSXV:PSL) provided a preliminary update on the first-stage reconnaissance drilling of its Petate project in Hidalgo, Mexico.

- Eight shallow holes have been completed to establish structure and allow for more accurate targeting of deeper mineralized zones.

- Initial holes are in the Apartadero zone, which had the highest gold and silver anomalies at surface.

- Assay results were received from five drill holes with highlights including 3.4m @ 3.5g/t Au & 1.6g/t Ag in hole PET-17-01.

- Prospero sees a strong correlation between the presence of black jasperoids after limestone and grade.

Analysis

Intersecting gold and silver grade in drill holes designed to test structural controls is encouraging. Shallow holes to be drilled soon will provide information on strike and dip of what Prospero thinks are the controlling structures. Figuring out the structural controls is a key step prior to targeting grade through drilling.

The drilling at Petate is being carried out as part of its reconnaissance drill campaign evaluation financed by strategic partner Fortuna Silver Mines Inc. over three of Prospero's projects

Comments