Oreninc Index Update: November 20th, 2017

ORENINC INDEX falls as brokered deals dry up

ORENINC INDEX - Monday, November 20th, 2017

North America’s leading junior mining finance data provider

ORENINC MINING DEAL CLUB

Access to high-quality, pre-vetted financing opportunities

www.miningdealclub.com

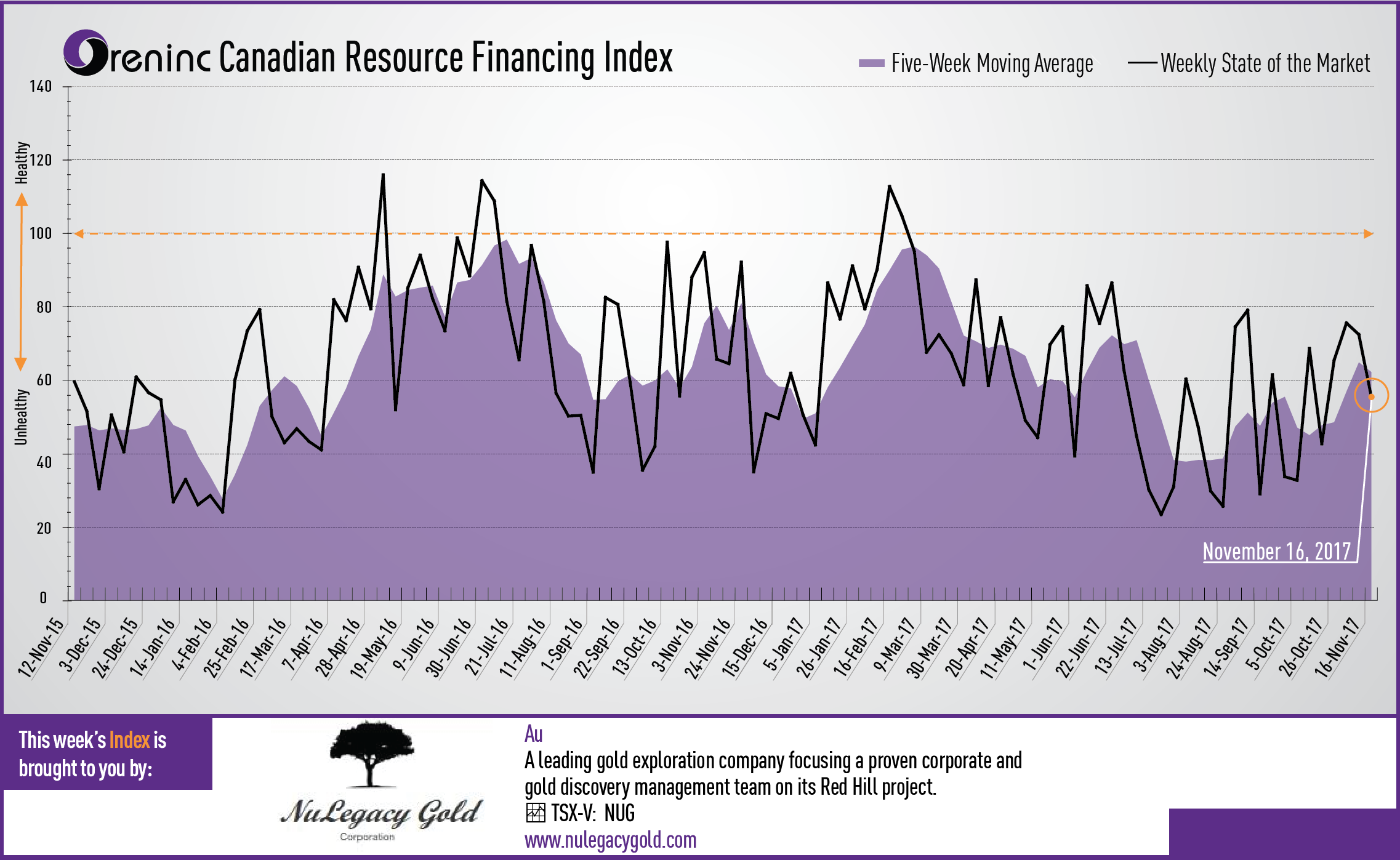

Last week index score: 72.44

This week: 55.59

LiCo Energy Metals (TSXV:LIC) provided an update on the diamond drilling program at its Teledyne and Glencore Bucke properties in Ontario, Canada.

Castle Silver Resources (TSXV:CSR) said an exploratory surface drill program intersected mineralization in each hole within 200m of the adit at the Castle Silver mine in Canada.

The Oreninc Index fell in the week ending November 17th, 2017 to 55.59 from 72.44 as the number of bought deals and brokered financings fell.

A quiet week on the geopolitical front in which perhaps the standout news item was a military takeover in Zimbabwe to force 93-year old president Robert Mugabe to stand aside after almost four decades in power.

Meanwhile, US president Donald Trump returned from his 12-day tour of Asia with a work agenda that includes trying to get his tax plan approved.

Total fund raises announced decreased ever-so-slightly to C$146.2 million, a two-week low, which included one brokered financing for C$2.7 million, a six-week low, and no bought-deal financings, also a six-week low. The average offer size fell slightly to C$4.1 million, a two-week low, whilst the total number of financings announced increased to 36, a two-week high.

Gold had a better week, making a run to regain the US$1,300/oz mark as it closed up at US$1,292/oz from US$1,275/oz a week ago. Gold is now up 12.6% since the start of the year. The van Eck managed GDXJ posted a similar growth chart, closing at US$32.40 from US$32.11 a week ago. It is now up 2.69% so far in 2017. The US Global Go Gold ETF also showed a similar chart to close at US$12.48 from US$12.34 last week. The SPDR GLD ETF saw inventories remain the same at 843 tonnes as they were a week ago.

In other commodities, silver also posted strong growth to close well above the US$17/oz mark at US$17.31/oz up from US$16.88/oz a week ago. Copper gained a little after a volatile week to close at US$3.09/lb from US$3.07/lb last week. Oil had an up-and-down week and closed slightly down at US$56.55 a barrel from US$56.74 a barrel a week ago.

The Dow Jones Industrial Average experienced a second losing week on the bounce to close at 23,358 from 23,422 last week. Canada’s S&P/TSX Composite Index slipped under 16,000 to close at 15,998 from 16,039 the previous week. The S&P/TSX Venture Composite Index saw more growth to close at 799.35 up from 796.48 the previous week.

This week also saw Oreninc CEO Kai Hoffmann present and moderate the finance panel at the Colombia Gold Symposium in Medellin, Colombia.

Summary:

- Number of financings increased to 36, a two-week high.

- One brokered financing was announced this week for C$2.7m, a six-week low.

- No bought-deal financings were announced this week, a six-week low.

- Total dollars slightly decreased to C$146.1m, a two-week low.

- Average offer size also slightly lowered to C$4.1m, a two-week low.

Financing Highlights

MAG Silver (TSX:MAG) opened a C$56.1 million offering on a best efforts basis. The deal is expected to close on or about November 28th.

- Offering of up to 4.2 million shares @ US$10.47 for gross proceeds of US$44.0 million that was subsequently increased to US$48.2 million.

- The proceeds will fund exploration and development of the Juanicipio project in Mexico that is being developed in partnership with Fresnillo.

Millennial Lithium (TSXV:ML) opened a C$30 million offering on a strategic deal basis.

- Strategic investment from Million Surge Holdings, a subsidiary of Golden Concord Group, one of the largest integrated energy services providers in China that specializes in clean energy and new energy.

- Million Surge will acquire 12.0 million shares @ C$2.50 in two tranches for the aggregate amount of C$30 million.

- A preliminary economic assessment is underway for Millennial’s Pastos Grandes project in Argentina.

Major Financing Openings:

- MAG Silver (TSX:MAG) opened a C$56.1 million offering on a best efforts basis. The deal is expected to close on or about November 28th.

- Millennial Lithium (TSXV:ML) opened a C$30 million offering on a strategic deal basis.

- Eco Atlantic Oil and Gas (TSXV:EOG) opened a C$14 million offering on a strategic deal basis.

- Bankers Cobalt (TSXV:BANC) opened a C$6 million offering on a best efforts basis. Each unit includes a warrant that expires in 36 months.

Major Financing Closings:

- Aquila Resources (TSX:AQA) closed a C$12.79 million offering on a strategic deal basis. Each unit included half a warrant that expires in 42 months.

- Galway Metals (TSXV:GWM) closed a C$4.13 million offering on a best efforts basis. Each unit included half a warrant that expires in 24 months.

- Kairos Capital (TSXV:KRS) closed a C$3.5 million offering on a best efforts basis. Each unit included half a warrant that expires in 18 months.

- Miramont Resources (CSE:MONT) closed a C$3 million offering underwritten by a syndicate led by Red Cloud Klondike Strike on a best efforts basis.

Company news

LiCo Energy Metals (TSXV:LIC) provided an update on the diamond drilling program at its Teledyne and Glencore Bucke properties in Ontario, Canada.

- The company has completed 27 diamond drill holes for a combined depth of about 3,106m to confirm and extend the existing known mineralization and to provide sufficient information to calculate a NI 43‐101 complaint resource estimate.

- On Glencore Bucke, it completed 21 holes totalling 1,900m, testing the Main and Northwest zones. The drill program has been completed as planned.

- On Teledyne, 1,206m has been completed in six holes and intersected Cobalt camp style mineralization in each drill hole. Drilling is expected to continue through November and early December.

Castle Silver Resources (TSXV:CSR) said an exploratory surface drill program intersected mineralization in each hole within 200m of the adit at the Castle Silver mine in Canada.

- Highlights included 0.65m @ 1.55% Co, 0.65% Ni, 0.61g/t Au & 8.8g/t Ag over 0.65.

Analysis

The results show that the historical mine operators overlooked the potential for cobalt, gold and base metals at the Castle mine.

Comments