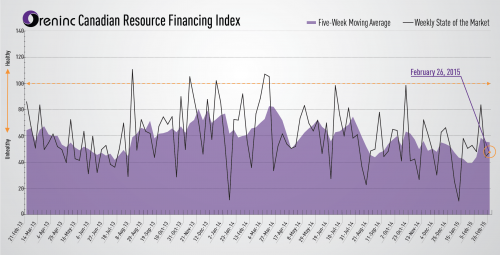

Oreninc Index Rises Marginally

The Oreninc Index rose marginally for the week ending February 26, 2015. Total dollars announced jumped to $59.2m, a two-week high. Three brokered financings were announced for $11.3m, a seven-week low. No bought deal financings were announced for the first time in seven weeks.

A number of smaller deals were announced for the week, with Couer d”Alene Mines Corporation’s (NYSE:CDE) acquisition of Goldcorp’s (NYSE:GG) Wharf Gold Mine for $105m the largest of note. Commodity prices had an up and down week; gold started off horribly before rallying to end the week. Copper also rallied, to a six-week high.

With 36 deals being announced — a nine-week high — it appears that companies were ready to try to raise some cash in anticipation of this week’s PDAC. With that said, the low average offer size indicates that, while companies would like to be raising money, they are not too confident it will happen at a significant level. The Index could certainly be worse, but any optimism that this year will be different is melting as we move closer to the spring months.