Oreninc Index: July 22, 2019

ORENINC INDEX falls although metals prices break out

ORENINC INDEX - Monday, July 22nd 2019

North America’s leading junior mining finance data provider

Sign up for our free newsletter at www.oreninc.com

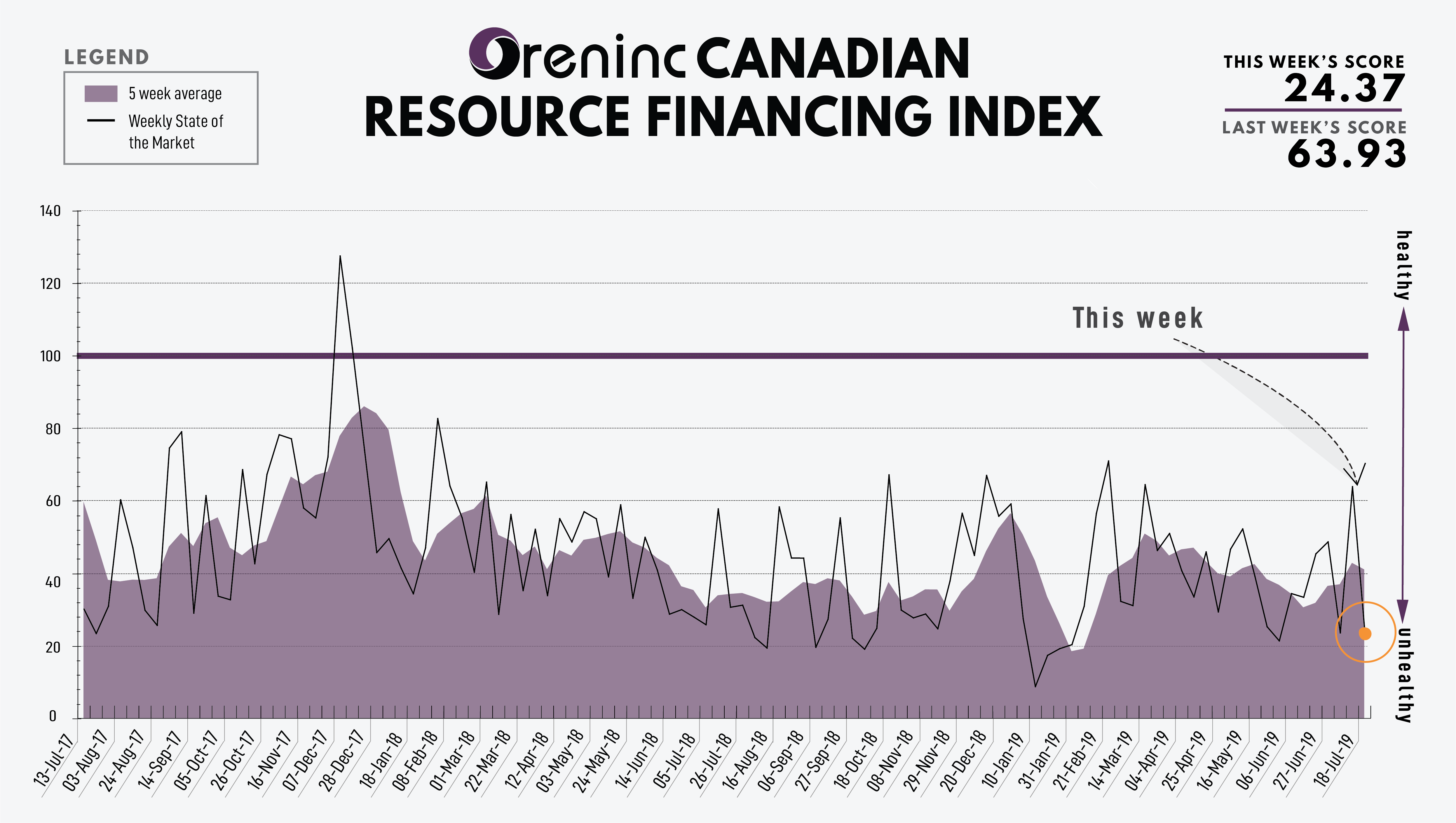

Last week index score: 63.93 (updated)

This week: 24.37

Silver Spruce Resources (TSXV:SSE) signed a binding letter of agreement to acquire the Cocula advanced gold project in Jalisco, Mexico.

Silver Spruce Resources (TSXV:SSE) receives Pino de Plata investment.

The Oreninc Index fell in the week ending July 19th, 2019 to 24.37 from an updated 63.93 a week ago despite precious metals prices breaking out.

Precious metals finally seemed to break out with both gold and silver trading at multi-month highs after billionaire generalist hedge fund manager Ray Dalio advised his clients to have gold in their portfolios.

On the geopolitical front, tensions in the Persian Gulf continue to increase after two oil tankers were intercepted by Iranian forces with US secretary of defense John Bolton increasingly pressing for military intervention against the Middle East nation.

On to the money: total fund raises fell back to C$37.7 million, a two-week low, which included one brokered financing for $6.0m, a five-week low and two bought-deal financings for $16.0m, a two-week low. The average offer size fell to $2.5 million, a two-week low, while the number of financings halved to 15.

Gold’s strength surfaced again as it closed up at US$1,415/oz from US$1,399/oz a week ago. The yellow metal is up 10.39% so far this year. The US dollar index showed weakness as it closed down up at 96.81 from 97.28 last week. The Van Eck managed GDXJ grew it closed up at US$35.81 from US$34.65 a week ago. The index is now up 18.50% so far in 2019. The US Global Go Gold ETF also closed up at US$14.65 from US$14.08 as a week ago. It is up 28.40% so far in 2019. The HUI Arca Gold BUGS Index closed up at 200.67 from 193.01 last week. The SPDR GLD ETF closed at more than 800 tonnes as it closed up at 800.54 tonnes from 796.97 tonnes a week ago.

In other commodities, silver closed up at US$15.22/oz from US$15.00/oz a week ago. Copper added a few cents as it closed up at US$2.69/lb from US$2.66/lb a week ago. Oil saw growth again as WTI closed up at US$60.21 a barrel from US$57.51 a barrel a week ago.

The Dow Jones Industrial Average kept pushing up records as it closed up at 27,332 from 26,922 a week ago. Canada’s S&P/TSX Composite Index closed down slightly at 16,488 from 16,541 the previous week. The S&P/TSX Venture Composite Index closed down as well at 576.03 from 586.79 last week.

Summary

· Number of financings decreased to 15.

· One brokered financing was announced this week for C$6.0m, a five-week low.

· Two bought-deal financings were announced this week for C$16.0m, a two-week low.

· Total dollars lowered to C$37.7m, a two-week low.

· Average offer down to C$2.5m, a two-week low.

Financing Highlights

Adventus Mining (TSXV:ADZN) entered into an agreement with a syndicate of underwriters led by Raymond James for a C$10.0 million bought deal private placement.

· 10 million shares @ C$1.00.

· Proceeds will be used to fund exploration and development activities at the Curipamba project in Ecuador and exploration and development activities within the Ecuador exploration alliance, including the Pijili and Santiago projects.

Discovery Metals (TSXV:DSV) announced a non-brokered private placement to raise C$9.0 million.

· 23.2 million shares @ C$0.23 and 15.9 million subscription receipts @ C$0.23.

· Eric Sprott agreed to purchase 17.6 million shares, which will result in him holding 19.9% stake in the company. He will also acquire 15.9 million subscription receipts which, if converted, will maintain his 19.9% interest in Discovery following the completion of the Levon Resources acquisition.

· Subscription receipt proceeds will be placed in escrow to be released on the closing of the Levon acquisition. On conversion, each will automatically convert into one share.

· Proceeds will be used to fund Discovery’s continuing exploration program at Cordero, following the closing of the Levon transaction, and the Coahuila projects.

Major Financing Openings

· Adventus Mining (TSXV:ADZN) opened a C$10.0 million offering on a bought deal basis.

· Discovery Metals (TSXV:DSV.H) opened a C$9.0 million offering on a best efforts basis.

· Harte Gold (TSXV:HRT) opened a C$6.0 million offering underwritten by a syndicate led by Echelon on a bought deal basis.

· Aurania Resources (TSXV:ARU) opened a C$4.0 million offering on a best efforts basis.

Major Financing Closings

· Pure Gold Mining (TSXV:PGM) closed a C$47.5 million offering underwritten by a syndicate led by Sprott Capital Partners on a bought deal basis.

· Osisko Metals (TSXV:OM) closed a C$10.0 million offering on a best efforts basis.

· Luminex Resources (TSXV:LR) closed a C$7.0 million offering on a best efforts basis.

· Mexican Gold (TSXV:MEX) closed a C$4.0 million offering on a best efforts basis.

Company News

Silver Spruce Resources (TSXV:SSE) signed a binding letter of agreement with Prospeccion y Desarrollo Minero del Norte (ProDeMin) to assume its option agreement to acquire the Cocula advanced gold project in Jalisco, Mexico.

· Very active exploration and mining region with several nearby projects including Agnico Eagle's El Barqueño exploration project and Endeavour Silver's Terronera development project.

· The agreement gives Silver Spruce a right of first refusal with a six-month due diligence period.

· Cocula covers 234 hectares that hosts part of a regional structural trend of gold, silver and base metal prospects with epithermal veins and breccia zones forming mineralized shoots hosted in intrusive rocks.

· Channel sampling by a previous operator across the outcrop of the Cocula breccia returned 136m @ 2.39g/t Au, 19g/t Ag, 1.07% Pb & 0.12% Zn.

· Previous operator drilled 27 RC holes for 1,974m in 2008.

· Terms include US$160,000 within two years of assumption of the ProDeMin contract; $330,000 in year three and $2.5 million in year four. The owners retain a 2% NSR capped at $1.5 million and of which 1% can be purchased for $500,000.

· Minimum work expenditures of $250,000 in the first two years and $500,000 within the following two years.

Analysis

This deal could reinvigorate Silver Spruce as it comprises a high-potential project on reasonable terms in a known district. As an advanced project, it provides the company with a meaningful opportunity and something more substantial to raise finance against at a time when precious metals prices are increasing. However, much will depend upon the company’s ability to finance exploration going forward.

Silver Spruce Resources (TSXV:SSE) receives Pino de Plata investment.

· Following the company’s May announcement of its plan to commence phase I drilling at Pino de Plata in Chihuahua, Mexico it received an unsolicited investment offer from a company controlled by the surface landowners.

· U$250,000 cash investment to purchase a 5% interest in Silver Spruce's Mexican subsidiary and a 5% interest in the mining titles that comprise Pino de Plata.

Analysis

This is a positive as it provides funds that allow phase I drilling to commence as well as meaning that local landowner interests are aligned with the company’s.

Comments