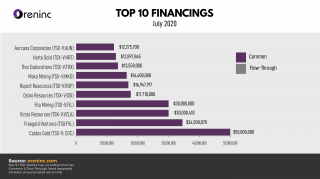

Gold accounted for six of the top ten largest financings closed in Canadian capital markets in July, with silver, lithium and oil collecting the other spots. The top ten deals...

Positions

-

1 (685X328) px

Positions

-

1 (685X328) px

Popular Position

-

1 (443x328) px

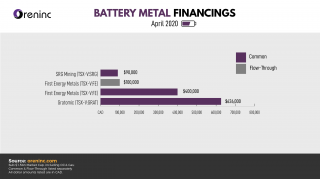

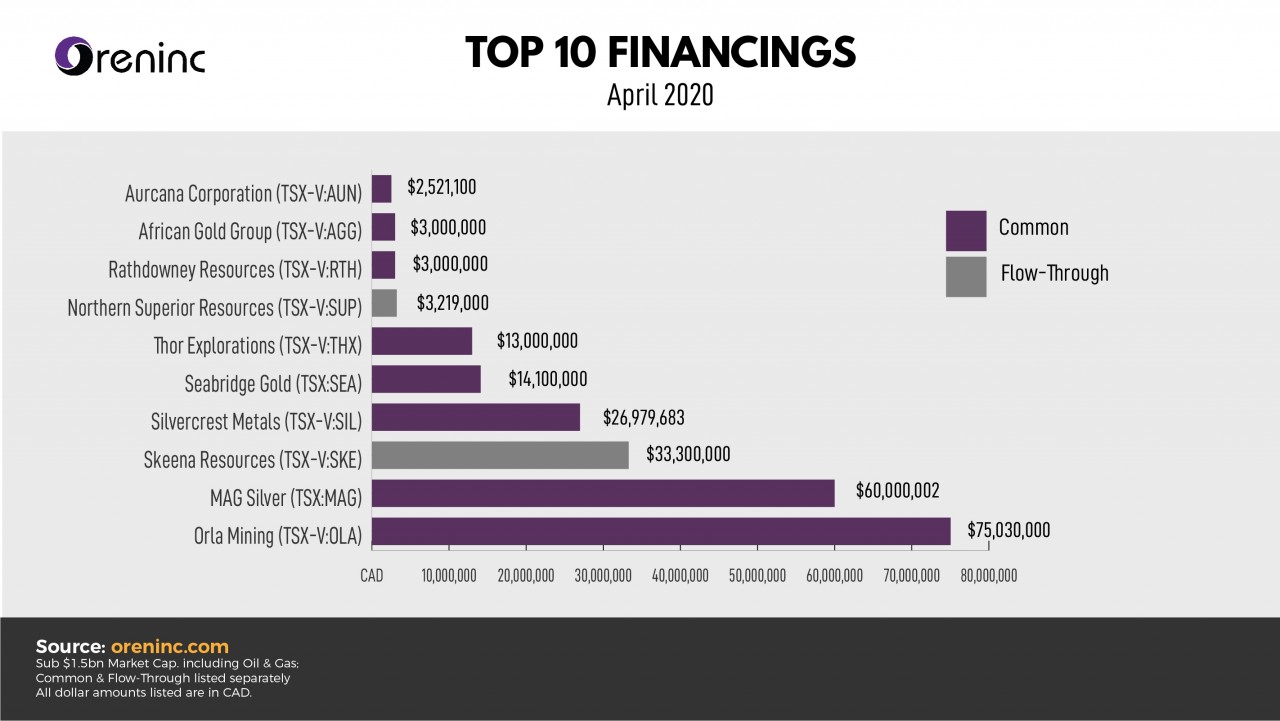

Gold accounted for six of the top ten largest financings closed in Canadian capital markets in April, with silver collecting three spots and zinc one. The top ten deals closed...

Gold accounted for six of the top ten largest financings closed in Canadian capital markets in April, with silver collecting three spots and zinc one. The top ten deals closed...

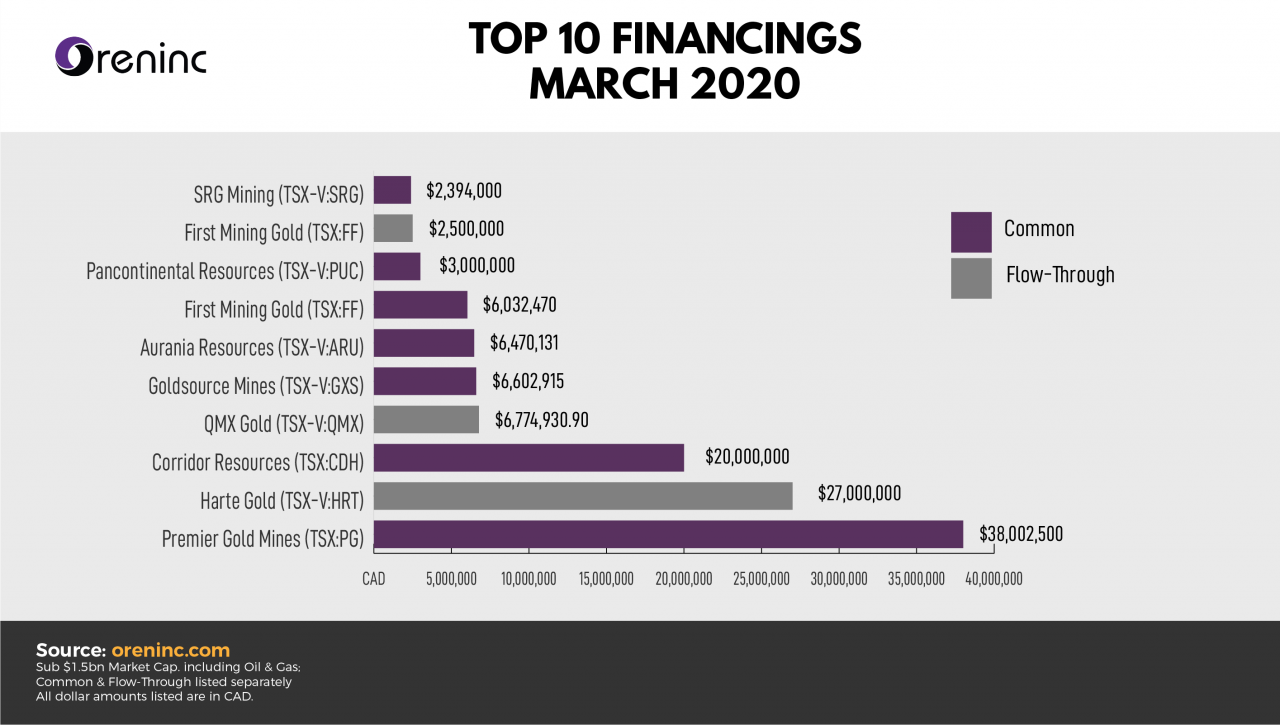

Gold accounted for eight of the top ten largest financing’s closed in Canadian capital markets in March, with oil & gas and graphite taking a spot each. The top ten...

Gold accounted for eight of the top ten largest financing’s closed in Canadian capital markets in March, with oil & gas and graphite taking a spot each. The top ten...