Oreninc Index: March 25, 2019

ORENINC INDEX down as raises fall away

ORENINC INDEX - Monday, March 25th 2019

North America’s leading junior mining finance data provider

Sign up for our free newsletter at www.oreninc.com

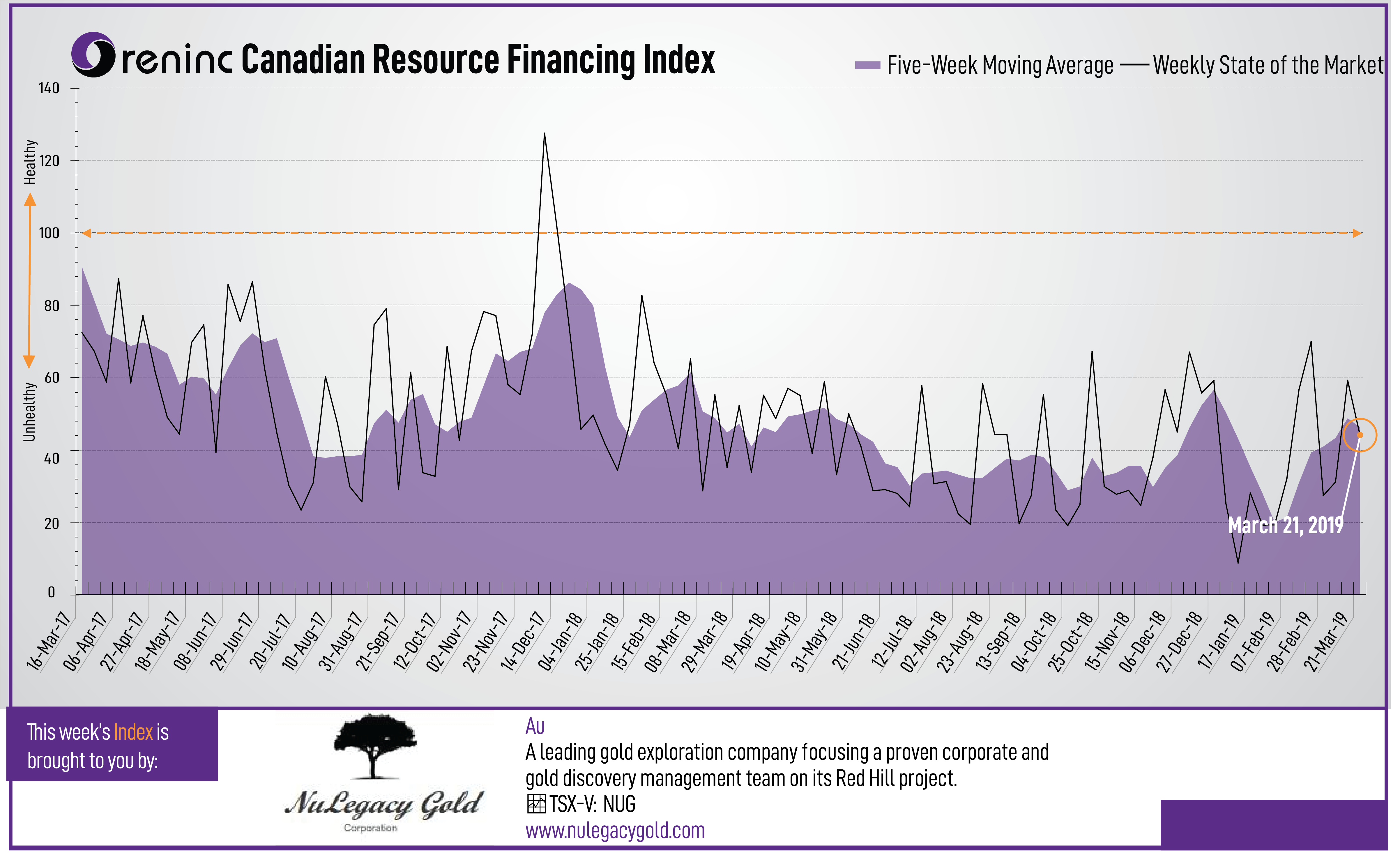

Last week index score: 59.23

This week: 44.28

The Oreninc Index fell in the week ending March 22nd, 2019 to 44.28 from 59.23 as dollars announced fell and the number of brokered deals fell away.

Gold had a calmer week of growth as the US Federal Resource Open Market Committee meeting continued its dovish stance towards future interest rate increases as the Fed lowered its growth forecast.

With the UK Parliament unable to agree how or if it wants to leave the European Union (EU) and the end of March deadline rapidly approaching, UK Prime Minister Teresa May went to Brussels to request more time. The EU gave her just two more weeks till April 12th.

A petition in the UK to revoke Article 50, the mechanism in the EU statutes that the UK invoked to state it wants to leave the body and remain in the EU has obtained over 4 million signatures and is growing fast, crashing UK government servers several times. Parliament will have to debate this motion.

On to the money: total fund raises announced increased to C$58.0 million, a one week high, that included one brokered financing for C$5.0 million, a one-week high and one bought-deal financing for C$5.0 million, also a one-week high. The average offer size shrank again to C$1.6 million, a five-week low, whilst the number of financings increased to 36, a five-week high.

Gold’s continued to show positive signs and consolidated above the US$1,300/oz level as it closed up at US$1,313/oz from US$1,302 a week ago. The yellow metal is up 2.43% so far this year. The US dollar index closed a smidge up at 96.65 from 96.59 last week. The van Eck managed GDXJ closed up at US$32.73 from US$32.33 a week ago. The index is up 8.31% so far in 2019. The US Global Go Gold ETF also closed up at US$13.31 from US$12.96 last week. It is up 16.67% so far in 2019. The HUI Arca Gold BUGS Index closed up at 173.14 from 169.38 last week. The SPDR GLD ETF continued to accrue as its inventory closed up at 781.03 tonnes from 771.04 tonnes a week ago.

In other commodities, silver spot closed up at US$15.42/oz from US$15.29/oz a week ago. Copper lost ground and closed down at US$2.84/lb from US$2.90/lb a week ago. Oil saw growth again as WTI closed up at US$59.04 a barrel from US$58.52 a barrel a week ago.

The Dow Jones Industrial Average sold off as it closed down at 25,502 from 25,848 last week. Canada’s S&P/TSX Composite Index closed down at 16,089 from 16,140 the previous week. The S&P/TSX Venture Composite Index closed up at 637.82 from 627.77 last week.

Summary

· Number of financings increased to 36, a five-week high.

· One brokered financing was announced this week for C$5.0m, a two-week low.

· One bought-deal financing was announced this week for C$5.0m, a two-week low.

· Total dollars decreased to C$58.0m, a two-week low.

· Average offer down to C$1.6m, a two-week low.

Financing Highlights

Alphamin Resources (TSXV:AFM) announced a non-brokered private placement of up to 79.8 million equity units @ C$0.20 to raise gross proceeds of up to C$15,96 million.

· Each unit will be comprised of one share and a warrant exercisable @ C$0.30 for three years.

· The net proceeds will be used to complete mine construction work on the Company’s Bisie tin project in DRC to fund an anticipated working capital shortfall instead of debt. A proposed working capital facility from lenders is not being proceeded with.

Major Financing Openings

· Alphamin Resources (TSXV:AFM) opened a C$15.96 million offering on a best efforts basis. Each unit includes a warrant that expires in three years.

· Aurion Resources (TSXV:AU) opened a C$5.0 million offering underwritten by a syndicate led by Haywood Securities on a bought deal basis. The deal is expected to close on or about April 10th.

· Auryn Resources (TSXV:AUG) opened a C$3.5 million offering on a best efforts basis. The deal is expected to close on or about March 29th.

· Crystal Lake Mining (TSXV:CLM) opened a C$3.5 million offering on a best efforts basis. Each unit includes a warrant that expires in two years.

Major Financing Closings

· Bonterra Resources (TSXV:BTR) closed a C$36.74 million offering on a best efforts basis.

· Bluestone Resources (TSXV:BSR) closed a C$22.43 million offering underwritten by a syndicate led by Cormark Securities on a bought deal basis. Each unit includes half a warrant that expires in two years.

· Standard Lithium (TSXV:SLL) closed a C$11.39 million offering on a bought deal basis. Each unit includes half a warrant that expires in three years.

· Havilah Mining (TSXV:HMC) closed a C$4.0 million offering on a best efforts basis.

Comments