Top 10 Financings of July 2017

July 2017 saw 138 financings close in the Canadian financial markets for C$656.1 million. 14 brokered financings closed in July for $249.1 million at an average size of $17.8 million, including ten bought deals for $186.8 million at an average size of $18.7 million.

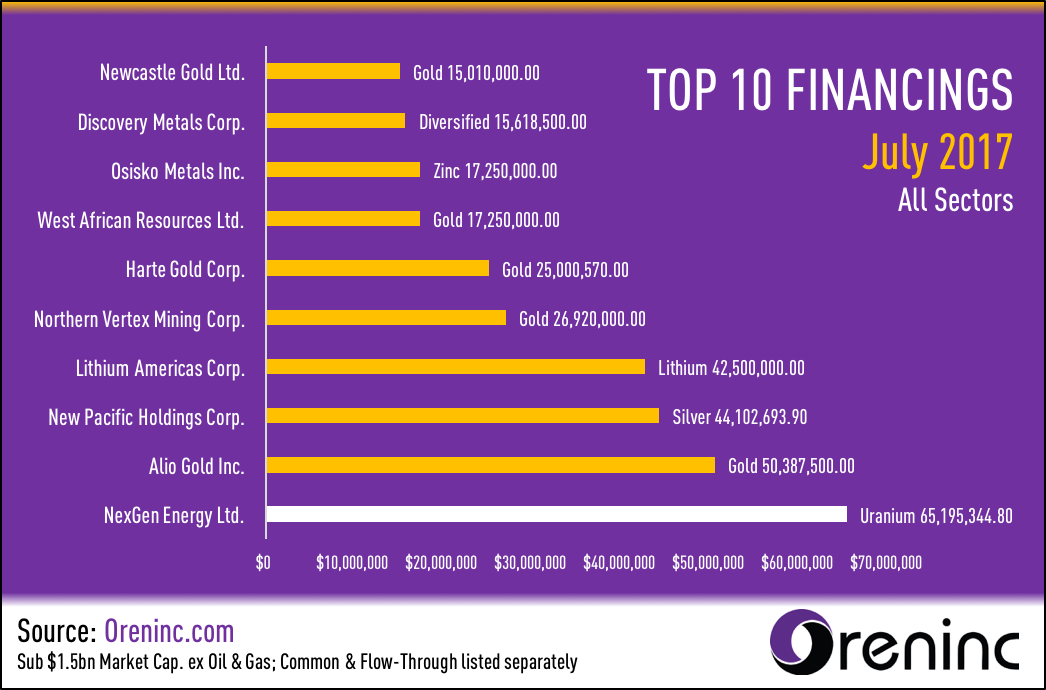

The top ten financings totalled $319.2 million with uranium company NexGen Energy taking top spot with $65.2 million. Gold companies took five of the top ten spots, with lithium, zinc and diversified one spot each.

#1 NexGen Energy $65.2 million

NexGen Energy (TSX: NXE) closed a US$50 million (C$65.2 million) stock placement with CEF Holdings and affiliates by selling 24.1 million shares @ C$2.70 to fund continuing exploration and development of its properties in the Athabasca Basin in Saskatchewan, Canada. The raise was part of a US$110 million financing with CEF Holdings and affiliates that in addition to the NexGen stock included US$60 million in unsecured convertible debentures. The debentures carry a 7.5% coupon over a 5-year term and are convertible into stock.

#2 Alio Gold $50.4 million

Alio Gold (TSX: ALO) raised $50.4 million to advance its Ana Paula gold project in Guerrero, Mexico via a bought deal underwritten by a syndicate led by Cormark Securities and Clarus Securities who purchased 8 million units @ $6.25. Each unit consisted of one share and half a warrant exercisable @ $8.00 for one year. The underwriters exercised their over-allotment option. Alio Gold was formerly Timmins Gold.

#3 New Pacific Holdings $44.1 million

New Pacific Holdings (TSXV: NUAG) closed financings for $44.1 million by selling 43.5 million subscription receipts @ US$0.80 for gross proceeds of US$34.8 million to pay the purchase price of the acquisition of Empresa Minera Alcira in Bolivia. Each subscription receipt is exercisable into one share. A subsidiary of Silvercorp Metals purchased 25 million subscription receipts. New Pacific subsequently raised an additional US$1.0 million by selling 1.3 million shares @ US$0.80. Alcira has seven silver-polymetallic mineral properties, the most significant of which is the Silver Sand property in Potosí department, which was drilled between 2012 and 2015.

Comments