In this presentation from SME - The New York Section on March 19th, Benjamin Cox discusses the aspects of the copper market -- especially in relation to current events -- that...

In this presentation from SME - The New York Section on March 19th, Benjamin Cox discusses the aspects of the copper market -- especially in relation to current events -- that...Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla efficitur turpis a nisl lobortis luctus. In accumsan augue lectus, non

posuere nisl gravida in. Integer orci libero, interdum id interdum euismod, molestie id tellus. Duis non facilisis nulla.

In this presentation from SME - The New York Section on March 19th, Benjamin Cox discusses the aspects of the copper market -- especially in relation to current events -- that...

In this presentation from SME - The New York Section on March 19th, Benjamin Cox discusses the aspects of the copper market -- especially in relation to current events -- that... On June 13, 2013, Oreninc Managing Director Benjamin Cox presented on the effects of scarcity on the the natural resources sector at Murdock Capital Partners Symposium in New York City. Click here...

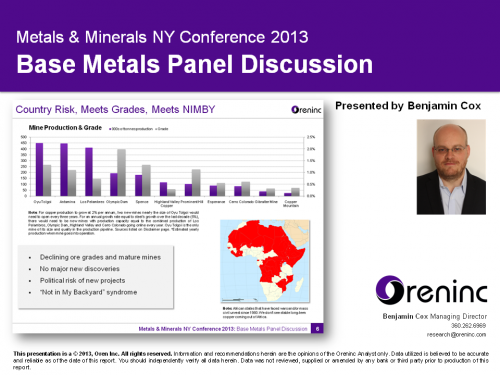

On June 13, 2013, Oreninc Managing Director Benjamin Cox presented on the effects of scarcity on the the natural resources sector at Murdock Capital Partners Symposium in New York City. Click here... The Oreninc Team exhibited at Metals & Minerals NYC earlier this week, on behalf of Aston Bay Holdings as well as Oreninc. Managing Director Benjamin Cox presented on "Base Metals" and...

The Oreninc Team exhibited at Metals & Minerals NYC earlier this week, on behalf of Aston Bay Holdings as well as Oreninc. Managing Director Benjamin Cox presented on "Base Metals" and... The Society for Mining, Metallurgy & Exploration is holding its first Current Trends in Mining Finance conference today and tomorrow in New York City. Our Managing Director, Benjamin Cox, will present...

The Society for Mining, Metallurgy & Exploration is holding its first Current Trends in Mining Finance conference today and tomorrow in New York City. Our Managing Director, Benjamin Cox, will present...TORONTO, March 14, 2013 – AGORACOM, a leading online financial community focusing on the small-cap and mid-cap markets, is pleased to announce details of the upcoming AGORACOM Online Uranium Conference. Open to investors around the world, the conference will feature online presentations from small-cap public companies and industry experts, including online Q&A sessions.

The online format of the Uranium Conference provides investors from outside traditional “conference cities” with an opportunity to fully participate in the process by watching presentations and interacting with conference participants – all from the comfort of their computers.

George Tsiolis, Founder of AGORACOM, stated “Our participating Uranium companies and experts are truly pioneers for having the vision to recognize that online conferences remove all barriers to participation, which brings together the largest possible audience of investors from around the world.”

During the presentation, Mr. Cox focused on three main points:

Overall 2011 was a weak year for fundraising, especially since March when the tsunami hit Japan. The market saw a seasonal slowdown due to effects of the tsunami, European debt, and fears of a double-dip recession in the U.S.

At PDAC 2012, Oreninc's MD, Benjamin Cox, presented a detailed overview of not only the financing environment for Canadian juniors, but also the general financing market environment.

He also discussed fundraising trends among junior mining companies based in Canada. The basic questions he addressed were: how much and what type of money was raised in each sector? Which companies raised money?

At the Yukon Geoscience Forum 2012, Oreninc’s MD, Benjamin Cox, discussed fundraising trends among NWT-focused junior mining companies.