ORENINC INDEX up as brokered activity surges again

ORENINC INDEX - Monday, September 7th 2020

North America’s leading junior mining finance data providerSubscribe for updates at oreninc.com/subscribe

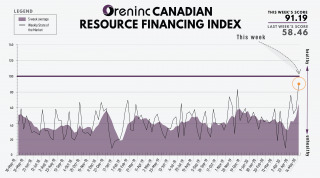

Last Week: 62.90

This...

Positions

-

1 (685X328) px

Positions

-

1 (685X328) px

Popular Position

-

1 (443x328) px