ORENINC INDEX down as lower value deals announced

ORENINC INDEX - Monday, August 31st 2020

North America’s leading junior mining finance data provider

Last Week: 72.68

This week: 62.90

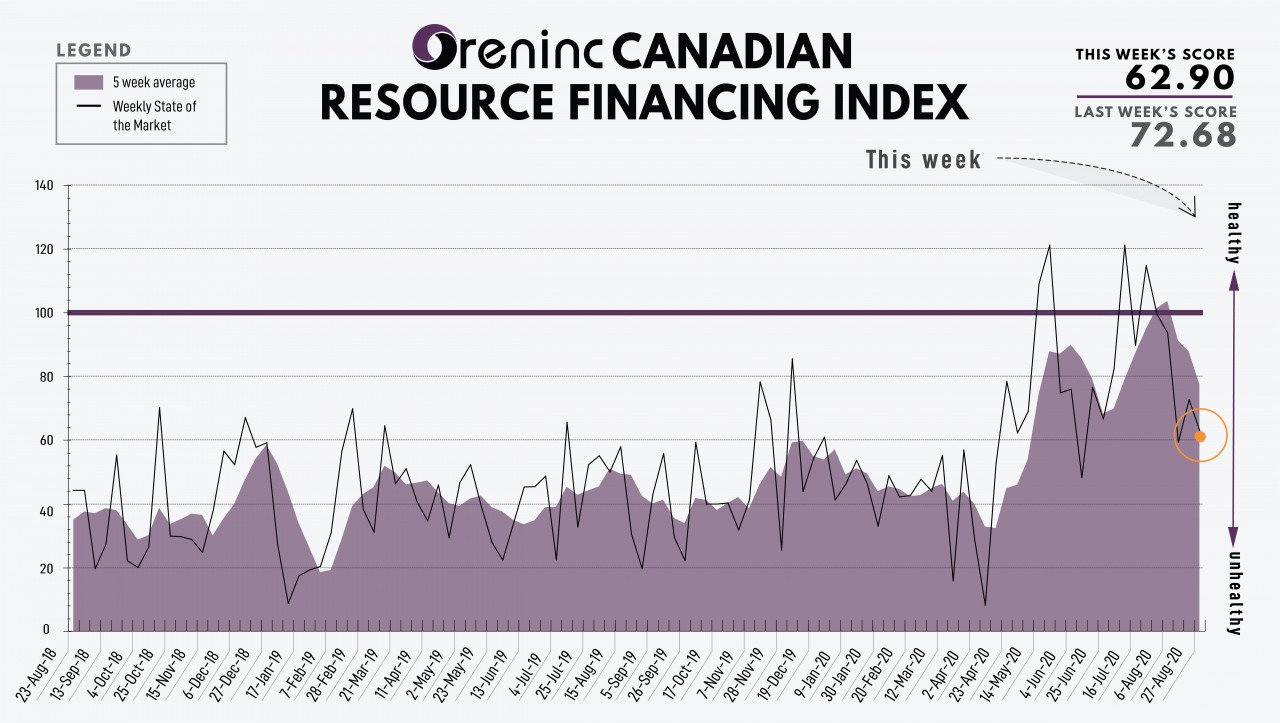

The Oreninc Index fell in the week ending August 28th, 2020 to 62.90 from 72.68 a week ago as more lower value deals were announced.

The COVID-19 virus global death toll has topped 840,000 with almost 25 million cases reported worldwide.

The key news event for the precious metals complex was the annual Jackson Hole meeting of the US Federal Reserve and after mulling the outcome overnight, the gold and silver prices closed the week strongly as all eyes focus on inflation.

At Jackson Hole, Fed chair Jerome Powell said the US central bank strategy is now to loosen its inflation guidelines to target average 2% inflation and focus on obtaining fuller employment. This caused many market watchers to figure that US interest rates will remain low for a very long time. Figures from the US Department of Commerce showed that its Core Personal Consumption Expenditures Index increased 0.3% in July with annual core inflation rising to 1.3% from June’s 1.1%.

The initial weekly jobless claims figures in the US dropped 98,000 to 1 million. The four-week moving average for new claims fell to 1.1 million according to US Labor Department figures. Continuing jobless claims were 14.5 million down 223,000 from the previous week’s revised level of 14.8 million.

Oil hit five-month highs as Hurricane Laura bowled into Texas and Louisiana prompting the closure of much US Gulf oil and gas installations.

Th copper price hit a two-year high of over $3/lb as LME inventories fell to their lowest levels in 14 years, of just 92,025 tonnes.

On the international scene, US-China tensions continue after China launched two missiles into the South China Sea a day after it claimed a US U2 spy plane entered a no-fly zone off its north coast.

On to the money: aggregate financings announced fell to $85.25 million, a two-week low, which included three brokered financings for $17 million, a two-week low, and three bought deal financings for $17 million, a two-week low. The average offer size fell to $1.8 million, a 10-week low, while the number of financings increased to 48.

Volatility for the Gold spot price continued with another volatile week as it closed the week up at $1,964/oz from $1,940/oz a week ago. The yellow metal is up 29.5% so far this year. The US dollar index resumed its losing streak as it closed down at 92.37 from 93.24 a week ago. The VanEck managed GDXJ returned to growth as it closed up at $59.79 from $57.20 a week ago. The index is now up 41.48% so far this year. The US Global Go Gold ETF also saw growth as it closed up at $24.12 from $23.42 a week ago. It is up 37.36% so far this year. The HUI Arca Gold BUGS Index also closed up at 348.72 from 336.87 last week. The SPDR GLD ETF inventory pared back a tad, closing the week down at 1,251.5 tonnes or 40.2 million ounces from 1,252.38 tonnes last week.

In other commodities, Silver also saw big swings before closing the week up at $27.50/oz from $26.79/oz a week ago. Copper held above the US$3/lb closing the week up at $3.01/lb from $2.93/lb a week ago. Oil continued to improve as WTI closed up at $42.97 a barrel from $42.34 a barrel a week ago.

The Dow Jones Industrial Average closed up again at 28,653 from 27,931 a week ago. Canada’s S&P/TSX Composite Index closed up at 16,705 from 16,514 the previous week. The S&P/TSX Venture Composite Index closed up at 745.31 from 737.65 last week.

Summary

- Number of financings increased to 48.

- Three brokered financings were announced this week for $17 million, a two-week low.

- Three bought-deal financings were announced this week for $17 million, a two-week low.

- Total dollars decreased to $85.25 million, a two-week low.

- Average offer fell to $1.8 million, a 10-week low.

Financing Highlights

Aftermath Silver (TSXV:AAG) opened a non-brokered private placement to raise $12.5 million.

- 19.3 million shares @ $0.65

- Subsequently increased to 24 million shares for $15.6 million

- Eric Sprott agreed to invest $5.4 million via the acquisition of 8.2 million shares to increase his ownership position to 19.9%.

- Proceeds will be used for drilling and technical studies on the Berenguela silver-copper project in Peru and the Challacollo and Cachinal silver-gold projects in Chile.

Major Financing Openings

- Aftermath Silver (TSXV:AAG) opened a $12.51 million offering on a best efforts basis.

- Pasofino Gold (TSXV:VEIN) opened a $10.02 million offering underwritten by a syndicate led by Stifel GMP on a bought deal basis. Each unit includes half a warrant that expires in a year. The deal is expected to close on or about September 10th.

- Monarch Gold (TSX:MQR) opened a $7.01 million offering underwritten by a syndicate led by Stifel GMP on a bought deal basis. Each unit includes half a warrant that expires in two years. The deal is expected to close on or about September 17th.

- Western Pacific Resources (TSXV:WRP) opened a $6.25 million offering on a best efforts basis.

Major Financing Closings

- Lion One Metals (TSXV:LIO) closed a $39.79 million offering underwritten by a syndicate led by Haywood Securities on a bought deal basis. Each unit included half a warrant that expires in a year.

- Bunker Hill Mining (CSE:BNKR) closed a $20.4 million offering underwritten by a syndicate led by Sprott Capital Partners on a best efforts basis. Each unit included a warrant that expires in three years.

- Dolly Varden Silver (TSXV:DV) closed a $10 million offering underwritten by a syndicate led by Mackie Research Capital on a best efforts basis. Each unit included half a warrant that expires in two years.

- Maritime Resources (TSXV:MAE) closed a $8.71 million offering underwritten by a syndicate led by Sprott Capital Partners on a bought deal basis

Comments