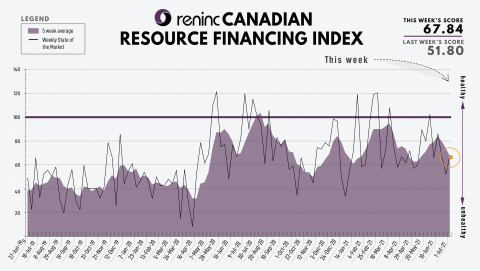

ORENINC INDEX - Monday, July 5th 2021

North America’s leading junior mining finance data provider

Last Week: 51.80

This week: 67.84

The Oreninc Index increased in the trading...

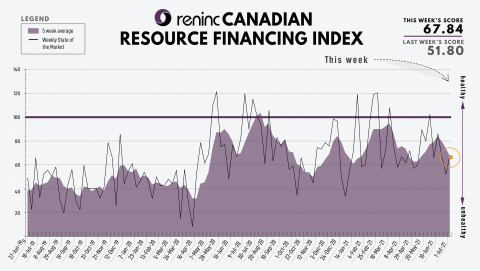

ORENINC INDEX - Monday, July 5th 2021

North America’s leading junior mining finance data provider

Last Week: 51.80

This week: 67.84

The Oreninc Index increased in the trading...Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla efficitur turpis a nisl lobortis luctus. In accumsan augue lectus, non

posuere nisl gravida in. Integer orci libero, interdum id interdum euismod, molestie id tellus. Duis non facilisis nulla.

ORENINC INDEX - Monday, July 5th 2021

North America’s leading junior mining finance data provider

Last Week: 51.80

This week: 67.84

The Oreninc Index increased in the trading...

ORENINC INDEX - Monday, July 5th 2021

North America’s leading junior mining finance data provider

Last Week: 51.80

This week: 67.84

The Oreninc Index increased in the trading... ORENINC INDEX - Monday, June 28th 2021

North America’s leading junior mining finance data provider

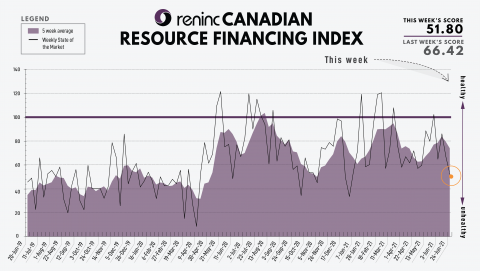

Last Week: 66.42

This week: 51.80

The Oreninc Index decreased in the trading...

ORENINC INDEX - Monday, June 28th 2021

North America’s leading junior mining finance data provider

Last Week: 66.42

This week: 51.80

The Oreninc Index decreased in the trading... ORENINC INDEX - Monday, June 21st 2021

North America’s leading junior mining finance data provider

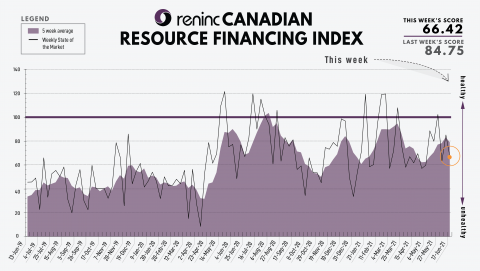

Last Week: 84.75

This week: 66.42

The Oreninc Index decreased in the trading...

ORENINC INDEX - Monday, June 21st 2021

North America’s leading junior mining finance data provider

Last Week: 84.75

This week: 66.42

The Oreninc Index decreased in the trading... ORENINC INDEX - Monday, June 14th 2021

North America’s leading junior mining finance data provider

Last Week: 63.64

This week: 84.75

The Oreninc Index increased in the trading...

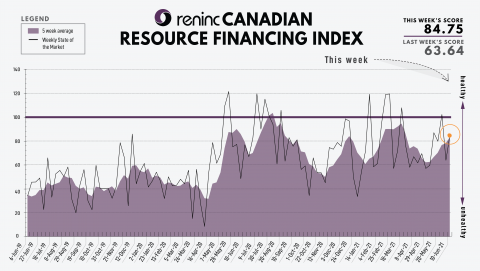

ORENINC INDEX - Monday, June 14th 2021

North America’s leading junior mining finance data provider

Last Week: 63.64

This week: 84.75

The Oreninc Index increased in the trading... ORENINC INDEX - Monday, June 7th 2021

North America’s leading junior mining finance data provider

Last Week: 101.92

This week: 63.64

The Oreninc Index decreased in the trading...

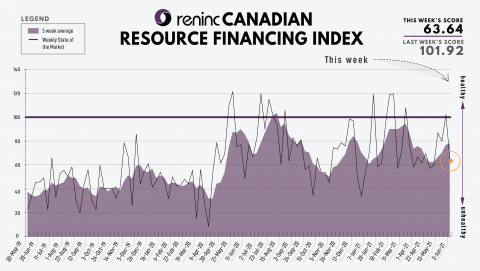

ORENINC INDEX - Monday, June 7th 2021

North America’s leading junior mining finance data provider

Last Week: 101.92

This week: 63.64

The Oreninc Index decreased in the trading... ORENINC INDEX - Monday, May 31st 2021

North America’s leading junior mining finance data provider

Last Week: 74.80

This week: 101.92

The Oreninc Index increased in the trading...

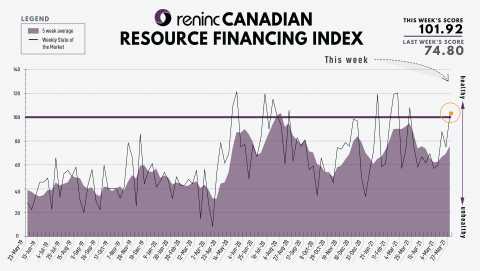

ORENINC INDEX - Monday, May 31st 2021

North America’s leading junior mining finance data provider

Last Week: 74.80

This week: 101.92

The Oreninc Index increased in the trading... ORENINC INDEX - Monday, May 27th 2021

North America’s leading junior mining finance data provider

Last Week: 82.82

This week: 74.80

The Oreninc Index decreased in the trading...

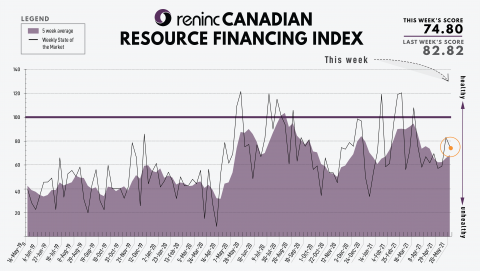

ORENINC INDEX - Monday, May 27th 2021

North America’s leading junior mining finance data provider

Last Week: 82.82

This week: 74.80

The Oreninc Index decreased in the trading... ORENINC INDEX - Monday, May 17th 2021

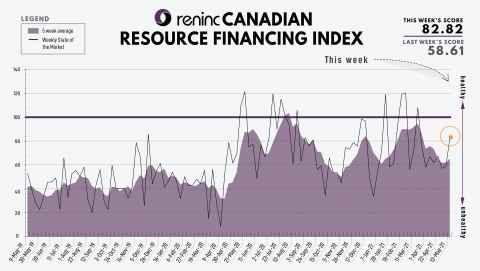

North America’s leading junior mining finance data provider

Last Week: 58.61

This week: 82.82

The Oreninc Index increased in the trading...

ORENINC INDEX - Monday, May 17th 2021

North America’s leading junior mining finance data provider

Last Week: 58.61

This week: 82.82

The Oreninc Index increased in the trading... ORENINC INDEX - Monday, May 10th 2021

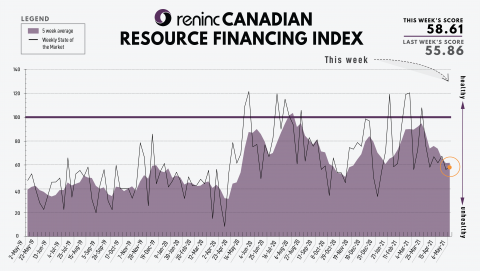

North America’s leading junior mining finance data provider

Last Week: 55.86 (Updated)

This week: 58.61

The Oreninc Index increased slightly in...

ORENINC INDEX - Monday, May 10th 2021

North America’s leading junior mining finance data provider

Last Week: 55.86 (Updated)

This week: 58.61

The Oreninc Index increased slightly in... ORENINC INDEX - Monday, May 3rd 2021

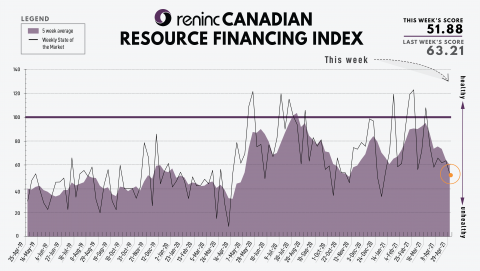

North America’s leading junior mining finance data provider

Last Week: 63.21 (Updated)

This week: 51.88

The Oreninc Index decreased in the trading...

ORENINC INDEX - Monday, May 3rd 2021

North America’s leading junior mining finance data provider

Last Week: 63.21 (Updated)

This week: 51.88

The Oreninc Index decreased in the trading...