ORENINC INDEX continues to improve as deal action increases – April 27, 2020

ORENINC INDEX continues to improve as deal action increases

ORENINC INDEX - Monday, April 27th 2020

North America’s leading junior mining finance data provider

Subscribe to our weekly newsletter at Oreninc.com

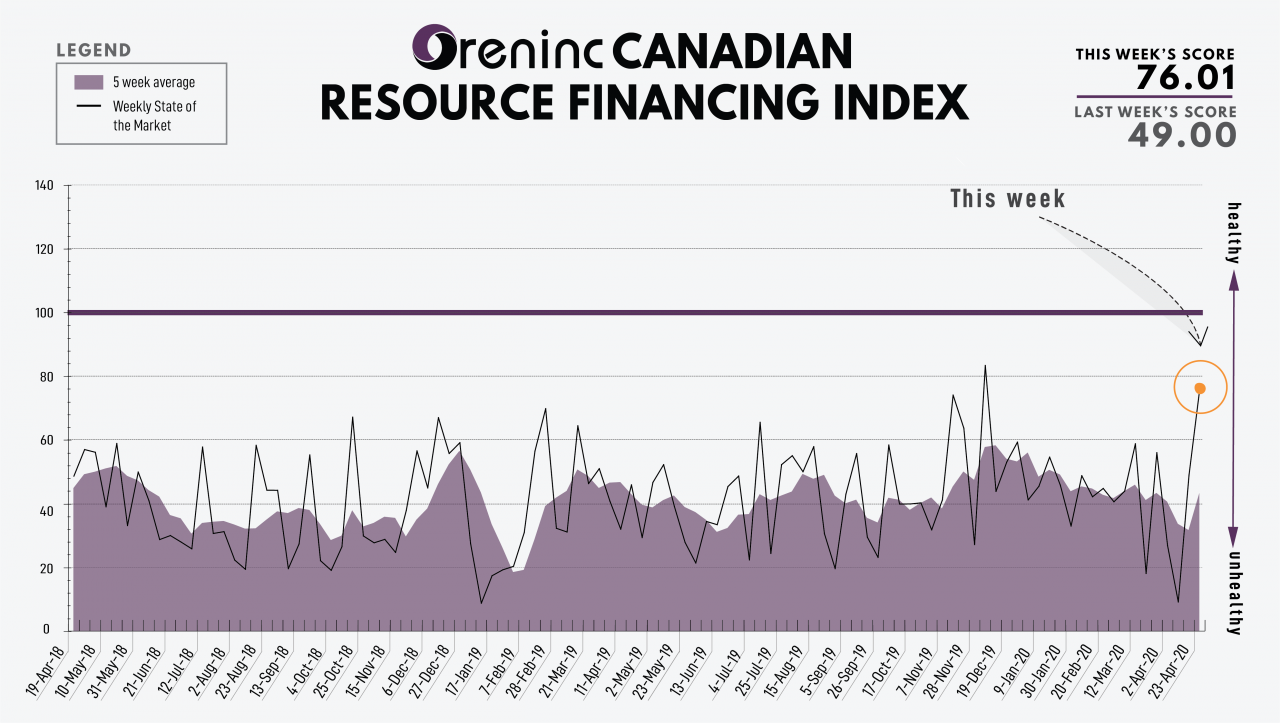

Last Week: 49.00

This week: 76.01

The Oreninc Index rebounded strongly in the week ending April 24th, 2020 to 76.01 from 49.00 a week ago as deal action increases.

The COVID-19 virus global death toll increased to over 203,000 and about 3 million cases reported. However, an increasing number of countries are looking at partially lifting quarantine restrictions to stem economic devastation at a national, local and individual household level, although epidemiologists saw this is premature.

Boom! The oil market imploded as overproduction and reduced demand meant the industry is running out of places to store the stuff, to the extent producers were paying people to take it off their hands, with oil futures going into negative territory. Producers recently agreed to cut production by 10% but demand has fallen much more than that. Will miners try to forward purchase fuel lock in these low prices? President Trump is looking to add up to 75 million barrels to the Strategic Petroleum Reserve.

In the US, stock markets are paradoxically buoyant despite the economic devastation caused by the lockdown measures to contain virus propagation, arguably due to the increasing amount of government money heading to businesses.

For example, the House of Representatives ratified the $484 billion small-business relief bill Frida including the Paycheck Protection Program. The bill is awaiting the signature of President Donald Trump.

The number of jobless in the US continues to grow with 4.43 million filing first-time jobless claims according to the Labour Department, the fifth straight week of more than three million new claims.

Purchasing Managers Indices (PMI) around the world continue a litany of doom, dropping to a record low in Germany.

On to the money: a much better week for financings as the total raises announced increased to $177.4 million, a 20-week high, which included three brokered financings for $102 million, a 123-week high, and two bought-deal financings for $100 million, a 124-week high. The average offer size increased to $5.2 million, a 12-week high, while the number of financings increased to 34.

Another good week for gold as the spot price closed up at $1,729/oz from $1.682/oz a week ago. The yellow metal is up 13.99% so far this year. The US dollar index increased again to 100.38 from 99.78 last week. The VanEck managed GDXJ continued to grow as it closed up at $41.70 from $36.37 a week ago. The index is down 1.33% so far in 2020. The US Global Go Gold ETF also saw growth as it closed up at $17.98 from $15.56 a week ago. It is up 2.39% so far in 2020. The HUI Arca Gold BUGS Index closed up as well at 277.59 from 244.41 last week. The SPDR GLD ETF inventory continued to increase as it closed up at 1,048.31 tonnes from 1,021.69 tonnes last week.

In other commodities, spot silver returned to growth as the spot price closed up at $15.25/oz from $15.18/oz a week ago. Copper shed a couple of cents as it closed down at $2.33/lb from $2.35/lb a week ago. A crazy week for the oil price as WTI fell to a low of negative $37.63 a barrel before recovering to close down at $16.94 a barrel from $18.27 a barrel a week ago.

The Dow Jones Industrial Average lost ground as it closed down at 23,775 from 24,242 a week ago. Canada’s S&P/TSX Composite Index closed up again at 14,420 from 14,359 the previous week. The S&P/TSX Venture Composite Index closed up at 462.64 from 444.87 last week.

Summary

- Number of financings increased to 34.

- Three brokered financings were announced this week for $102 million, a 123-week high.

- Two bought-deal financings were announced this week for $100 million, a 124-week high.

- Total dollars increased to $177.4 million, a 20-week high.

- Average offer increased to $5.2 million, a 12-week high.

Financing Highlights

Bluestone Resources (TSXV:BSR) opened a $80.01 million bought deal offering.

- Syndicate of underwriters led by Canaccord Genuity

- 45.7 million shares @ $1.75.

- Proceeds will be used to advance the Cerro Blanco gold development project in Guatemala.

- The deal is expected to close on or about May 4th.

Major Financing Openings

- Bluestone Resources (TSXV:BSR) opened a $80.01 million offering underwritten by a syndicate led by Canaccord Genuity on a bought deal basis. The deal is expected to close on or about May 4th.

- Silvercrest Metals (TSXV:SIL) opened a $26.98 million offering on a strategic deal basis.

- Spartan Delta (TSXV:RTN) opened a $20 million offering on a best efforts basis. The deal is expected to close on or about May 8th.

- Victoria Gold (TSXV:VIT) opened a $20 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis.

Major Financing Closings

- African Gold Group (TSXV:AGG) closed a $3 million offering on a best efforts basis. Each unit included half a warrant that expires in two years.

- Rathdowney Resources (TSXV:RTH) closed a $3 million offering on a best efforts basis. Each unit included a warrant that expires in five years.

- Aurcana (TSXV:AUN) closed a $2.52 million offering on a best efforts basis. Each unit included a warrant that expires in three years.

- Impact Silver (TSXV:IPT) closed a $2 million offering on a best efforts basis.

Popular Position

-

1 (443x328) px

Positions

-

1 (685X328) px

Positions

-

1 (685X328) px

Comments