ORENINC INDEX lower following weak precious metals sentiment

ORENINC INDEX - Monday, August 9th 2021

North America’s leading junior mining finance data provider

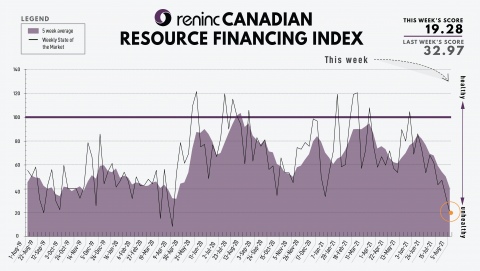

Last Week: 32.97 (Updated)

This week: 19.28

The Oreninc Index decreased in the trading week ending August 6th, 2021 to 19.28 from 32.97 a week ago as the financings activity follows the weak precious metals sentiment.

On to the money: the aggregate financings announced increased to $34.2 million, a 1-week high, with 2 new brokered financings and no new bought-deal financings announced. The average offer size increased to $4 million, a 1-week low, and the number of financings decreased to 8.

Gold closed the week down at $1,762/oz from $1,817/oz a week ago. The US dollar index closed up at 92.80 from 92.17 a week ago.

The widely followed junior mining index, the VanEck managed GDXJ, closed the week higher at $43.60 from $45.83 a week ago. HUI Arca Gold BUGS Index, which follows the major gold miners, closed the week lower at 259.69 from 273.72 last week. The SPDR GLD ETF inventory closed the week higher at 1,025.29 tonnes, or 32.96 million ounces, from 1,029.71 tonnes last week.

In other commodities, Silver closed the week lower at $24.32/oz from $25.23/oz a week ago. Copper closed lower at $4.33/lb from $4.47/lb a week ago. Oil went higher as WTI closed lower at $68.28 a barrel from $73.95 a barrel a week ago.

The Dow Jones Industrial Average closed higher at 35,075 from 34,936 a week ago. Canada’s S&P/TSX Composite Index closed higher at 20,475 from 20,287 the previous week. The S&P/TSX Venture Composite Index closed higher at 925.65 from 925.63 a week ago.

Summary:

• Number of financings decreased to 8.

• Two brokered financings were announced this week for $4m, a 32-week low.

• No bought-deal financing was announced this week.

• Total dollars increased to $34.2m, a 1-week high.

• Average offer increased to $4m, a 1-week high.

Major Financing Openings:

• Highland Copper Company Inc. (TSX-V:HI) opened a $26 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months.

• St James Gold Corp. (TSX-V:LORD) opened a $4 million offering underwritten by a syndicate led by Canaccord Genuity Corp. on a best efforts basis. Each unit includes 1 warrant that expires in 36 months. The deal is expected to close on or about August 26, 2021.

• Puma Exploration Inc. (TSX-V:PUM) opened a $1.6 million offering on a best efforts basis. The deal is expected to close on or about August 13, 2021.

• Riley Gold Corp. (TSX-V:RLYG) opened a $1.6 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months.

Major Financing Closings:

• Newcore Gold Ltd. (TSX-V:NCAU) closed a $11.5 million offering underwritten by a syndicate led by Cormark Securities Inc. on a bought deal basis. The deal is expected to close on or about August 4, 2021.

• New Stratus Energy Inc. (TSX-V:NSE) closed a $9.66 million offering underwritten by a syndicate led by Canaccord Genuity Corp. on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months. The deal is expected to close on or about June 30, 2021.

• Wealth Minerals Ltd. (TSX-V:WML) closed a $3.04 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months. The deal is expected to close on or about July 30, 2021.

• Blue Sky Uranium Corp. (TSX-V:BSK) closed a $2.13 million offering on a best efforts basis.

Comments