ORENINC INDEX rebounds strongly as financings resume – April 20, 2020

ORENINC INDEX rebounds strongly as financings resume

ORENINC INDEX - Monday, April 20th 2020

North America’s leading junior mining finance data provider

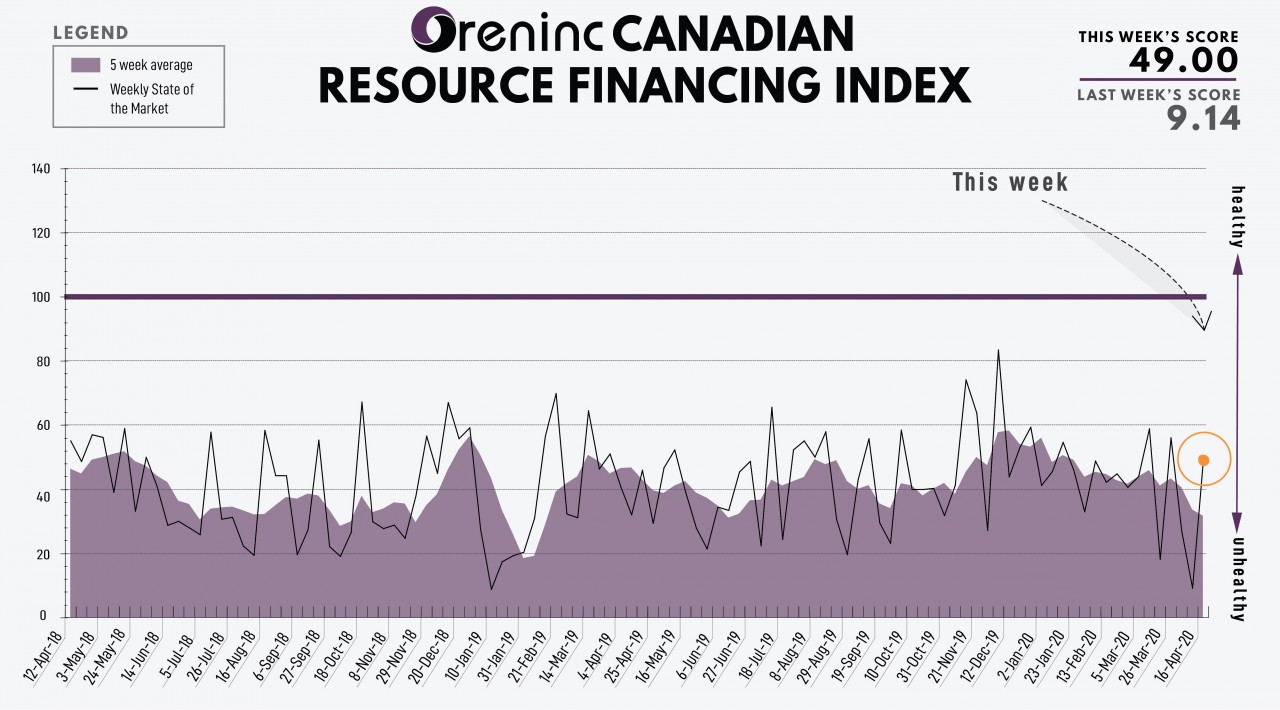

Last Week: 9.14

This week: 49.00

The Oreninc Index rebounded strongly in the week ending March April 17th, 2020 to 49.00 from 9.14 a week ago as financing activity resumed following the Easter break.

The COVID-19 virus continues to wreak havoc with the global death toll now over 156,000 and more than 2.3 million cases reported. However, many countries are now starting to plan for what comes next and the moment when travel restrictions can be lifted and economic activity can resume.

Stock markets around the world have been rallying and trending higher as the feeling grows that perhaps the worst is behind us, but at what cost and can things return to normal?

China posted its first economic contraction in decades with GDP growth down 6.8% in the first quarter compared to the same period in 2019 while in the US layoffs continue. Another 5.25 million people filed initial jobless claims this past week according to Labor Department data, the fourth straight week that new claims topped 3 million. Some 22.03 million claims have been filed during the past four weeks or about 15% of the previously employed population. Continuing jobless claims increased 4.53 million to a seasonally adjusted 11.98 million.

At a time when the world needs to pull together, US President Donald Trump said he will freeze payments to the World Health Organization (WHO) over its handling of the coronavirus pandemic.

In Europe, the European Union agreed a €500bn support package for countries hit hardest by the coronavirus pandemic amid concerns the very existence of the bloc was at stake.

Oil continues to receive a battering due to low demand despite Opec producers and non-members agreeing to cut output by around 10% recently. Prices for the WTI benchmark fell under US$20 a barrel as inventories build to levels that threaten to overwhelm storage capacity.

On to the money: a much better week for financings as the total raises announced rebounded to $108 million, a five-week high, which included no brokered financings and no bought-deal financings. The average offer size rebounded strongly to $4.3 million, a three-week high, while the number of financings increased to 25.

The growth in the gold spot price continued, cresting at US$1,747/oz before pulling back on profit-taking as the week ended to close down at $1.682/oz from $1,696/oz a week ago. The yellow metal is up 10.91% so far this year. The US dollar index increased slightly to 99.78 from 99.48 last week. The VanEck managed GDXJ continued to grow as it closed up at $36.37 from $35.65 a week ago. The index is down 13.94% so far in 2020. The US Global Go Gold ETF also saw growth as it closed up at 415.56 from $14.88 a week ago. It is down 11.39% so far in 2020. The HUI Arca Gold BUGS Index closed up as well at 244.41 from 232.74 last week. The SPDR GLD ETF inventory broke through the 1,000 tonnes mark for the first time since June 2013 as it closed up at 1021.69 tonnes from 994.19 tonnes.

In other commodities, spot silver lost some ground as it closed down at $15.18/oz from $15.57/oz a week ago. Copper’s revival continued as it closed up at $2.35/lb from $2.25/lb a week ago. The oil price resumed its downward spiral as WTI fell to $18.27 a barrel from $22.76 a barrel a week ago.

The Chicago Board Options Exchange Volatility Index (VIX or fear index) continued to fall, closing down at 38.15 from 41.67 a week ago.

The Dow Jones Industrial Average continued to gain as it closed up at 24,242 from 23,719 a week ago. Canada’s S&P/TSX Composite Index followed suit as it closed up at 14,359 from 14,166 the previous week. The S&P/TSX Venture Composite Index closed up at 444.87 from 421.97 last week.

Financing Highlights

SilverCrest Metals (TSX:SIL) opened a non‑brokered private placement to raise $75 million.

- 10 million shares @ $7.50 to be purchased by accredited or institutional investors.

- The placement follows an aborted bought deal attempt with National Bank Financial a month ago.

- Proceeds to be used for the continued exploration and development of the Las Chispas project in Sonora, Mexico.

- SilverCrest subsequently upsized and closed the placement for proceeds of $101 million

Summary

- Number of financings increased to 25.

- No brokered financings were announced this week.

- No bought-deal financings were announced this week.

- Total dollars increased to $108 million, a five-week high.

- Average offer augmented to $4.3 million, a three-week high.

Major Financing Openings

- Silvercrest Metals (TSXV:SIL) opened a $75 million offering on a best efforts basis. The deal is expected to close on or about April 17th.

- IMC International Mining (CSE:IMCX) opened a $8 million offering on a best efforts basis.

- Golden Birch Resources (CSE:GBRX) opened a $6 million offering on a best efforts basis. Each unit includes a warrant that expires in five years.

- Fortune Bay (TSX:FOR) opened a $2.75 million offering on a best efforts basis. Each unit includes half a warrant that expires in three years.

Major Financing Closings

- Skeena Resources (TSXV:SKE) closed a $33.3 million offering on a best efforts basis.

- Seabridge Gold (TSX:SEA) closed a $14.1 million offering on a best efforts basis.

- Fireweed Zinc (TSXV:FWZ) closed a $1.14 million offering on a best efforts basis. Each unit included a 1 warrant that expires in five years.

- Bayhorse Silver (TSXV:BHS) closed a $0.86 million offering on a best efforts basis.

Positions

-

1 (685X328) px

Positions

-

1 (685X328) px

Popular Position

-

1 (443x328) px

Comments