ORENINC INDEX remains steady as average offer size increases

ORENINC INDEX - Monday, April 19th 2021

North America’s leading junior mining finance data provider

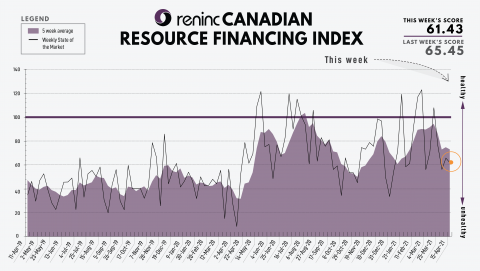

Last Week: 65.45

This week: 61.43

The Oreninc Index decreased by only 4 points in the trading week ending April 16th, 2021 to 61.43 from 65.45 a week ago as the average offer size saw a modest increase.

On to the money: the aggregate financings announced increased to $134.7 million, a 5-week high, with 5 new brokered financings and 1 new bought-deal financings announced. The average offer size increased to $5.2 million, a 2-week high, and the number of financings increased to 26.

Gold closed the week higher at $1,779/oz from $1,743/oz a week ago. The US dollar index closed lower at 91.56 from 92.18 a week ago.

The widely followed junior mining index, the VanEck managed GDXJ, closed the week higher at $50.32 from $48.76 a week ago. HUI Arca Gold BUGS Index, which follows the major gold miners, closed the week higher at 292.05 from 283.08 last week. The SPDR GLD ETF inventory closed the week down at 1,019.66 tonnes, or 32.78 million ounces, from 1,026.07 tonnes last week.

In other commodities, Silver closed the week higher at $26.10/oz from $25.32/oz a week ago. Copper closed up at $4.16/lb from $4.04/lb a week ago. Oil went higher as WTI closed up at $63.13 a barrel from $59.32 a barrel a week ago.

The Dow Jones Industrial Average closed up at 34,200 from 33,800 a week ago. Canada’s S&P/TSX Composite Index closed up at 19,351 from 19,288 the previous week. The S&P/TSX Venture Composite Index closed lower at 944.46 from 959.37 a week ago.

Summary:

• Number of financings increased to 26.

• Five brokered financings were announced this week for $74m, a 3-week high.

• One bought-deal financing was announced this week for $20.6m, a 15-week low.

• Total dollars increased to $134.7m, a 3-week high.

• Average offer upped to $5.2m, a 2-week high.

Major Financing Openings:

• Candelaria Mining Corp. (TSX-V:CXX) opened a $25 million offering underwritten by a syndicate led by Echelon Wealth Partners Inc. on a best efforts basis. Each unit includes 1 warrant that expires in 24 months. The deal is expected to close on or about May 14, 2021.

• Novo Resources Corp. (TSX-V:NVO) opened a $22 million offering underwritten by a syndicate led by Clarus Securities Inc. on a best efforts basis. Each unit includes a 1/2 warrant that expires in 36 months. The deal is expected to close on or about April 5, 2021.

• Ascot Resources Ltd. (TSX-V:AOT) opened a $20.64 million offering underwritten by a syndicate led by Stifel GMP on a bought deal basis. The deal is expected to close on or about April 20, 2021.

• Decklar Resources Inc. (TSX-V:DKL) opened a $15 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 12 months.

Major Financing Closings:

• Ascot Resources Ltd. (TSX-V:AOT) closed a $61 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis. The deal is expected to close on or about April 9, 2021.

• Skeena Resources Limited (TSX-V:SKE) closed a $21.55 million offering on a best efforts basis. The deal is expected to close on or about March 24, 2021.

• Wallbridge Mining Company Ltd. (TSX:WM) closed a $20.01 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis. The deal is expected to close on or about April 15, 2021.

• Talisker Resources Ltd. (CSE:TSK) closed a $19.1 million offering on a best efforts basis. The deal is expected to close on or about April 15, 2021.

Comments