ORENINC INDEX sharply higher showing signs of live

ORENINC INDEX - Monday, August 16th 2021

North America’s leading junior mining finance data provider

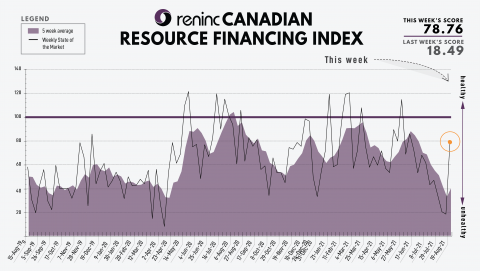

Last Week: 18.49

This week: 78.76

The Oreninc Index increased in the trading week ending August 20th, 2021 to 78.76 from 18.49 a week ago showing financing activity is picking up nearing the end of the summer doldrums.

On to the money: the aggregate financings announced increased to $188.5 million, a 5-week high, with 4 new brokered financings and 2 new bought-deal financings announced. The average offer size decreased to $7.5 million, a 27-week high, and the number of financings increased to 25.

Gold closed the week up at $1,784/oz from $1,778/oz a week ago. The US dollar index closed up at 93.50 from 92.52 a week ago.

The widely followed junior mining index, the VanEck managed GDXJ, closed the week lower at $39.69 from $42.85 a week ago. HUI Arca Gold BUGS Index, which follows the major gold miners, closed the week lower at 254.96 from 254.96 last week. The SPDR GLD ETF inventory closed the week higher at 1,011.61 tonnes, or 32.52 million ounces, from 1,021.79 tonnes last week.

In other commodities, Silver closed the week lower at $23.11/oz from $23.77/oz a week ago. Copper closed lower at $4.13/lb from $4.35/lb a week ago. Oil went higher as WTI closed lower at $62.32 a barrel from $68.44 a barrel a week ago.

The Dow Jones Industrial Average closed lower at 35,118 from 35,501 a week ago. Canada’s S&P/TSX Composite Index closed lower at 20,339 from 20,518 the previous week. The S&P/TSX Venture Composite Index closed lower at 864.51 from 923.06 a week ago.

Summary:

• Number of financings increased to 25.

• Four brokered financing were announced this week for $164m, a 22-week high.

• Two bought-deal financing were announced this week for $91m, a 22-week high.

• Total dollars increased to $188.5m, a 6-week high.

• Average offer heightened to $7.5m, a 27-week high.

Major Financing Openings:

• G Mining Ventures Corp. (TSX-V:GMIN) opened a $70.02 million offering underwritten by a syndicate led by Sprott Capital Partners LP on a bought deal basis. Each unit includes a 1/2 warrant that expires in 36 months. The deal is expected to close on or about September 9, 2021.

• Perpetua Resources Corp. (TSX-V:PPTA) opened a $62.91 million offering underwritten by a syndicate led by B. Riley Securities Inc. on a best efforts basis. The deal is expected to close on or about August 17, 2021.

• UEX Corp. (TSX-V:UEX) opened a $21.16 million offering underwritten by a syndicate led by Sprott Capital Partners on a bought deal basis. Each unit includes a 1/2 warrant that expires in 36 months. The deal is expected to close on or about September 7, 2021.

• Nova Royalty Corp. (TSX-V:NOVR) opened a $10 million offering underwritten by a syndicate led by PI Financial Corp. on a best efforts basis. The deal is expected to close on or about August 25, 2021.

Major Financing Closings:

• Perpetua Resources Corp. (TSX-V:PPTA) closed a $62.91 million offering underwritten by a syndicate led by B. Riley Securities Inc. on a best efforts basis. The deal is expected to close on or about August 17, 2021.

• Fabled Silver Gold Corp. (TSX-V:FCO) closed a $23.25 million offering underwritten by a syndicate led by Research Capital Corp. on a best efforts basis. Each unit includes 1 warrant that expires in 24 months. The deal is expected to close on or about July 12, 2021.

• Falco Resources Ltd. (TSX-V:FPC) closed a $12.28 million offering underwritten by a syndicate led by CIBC Capital Markets on a bought deal basis. Each unit includes a 1/2 warrant that expires in 48 months. The deal is expected to close on or about August 18, 2021.

Comments