ORENINC INDEX up as brokered deals increase – May 11, 2020

ORENINC INDEX - Monday, May 11th 2020

North America’s leading junior mining finance data provider

Subscribe for weekly updates at oreninc.com/subscribe

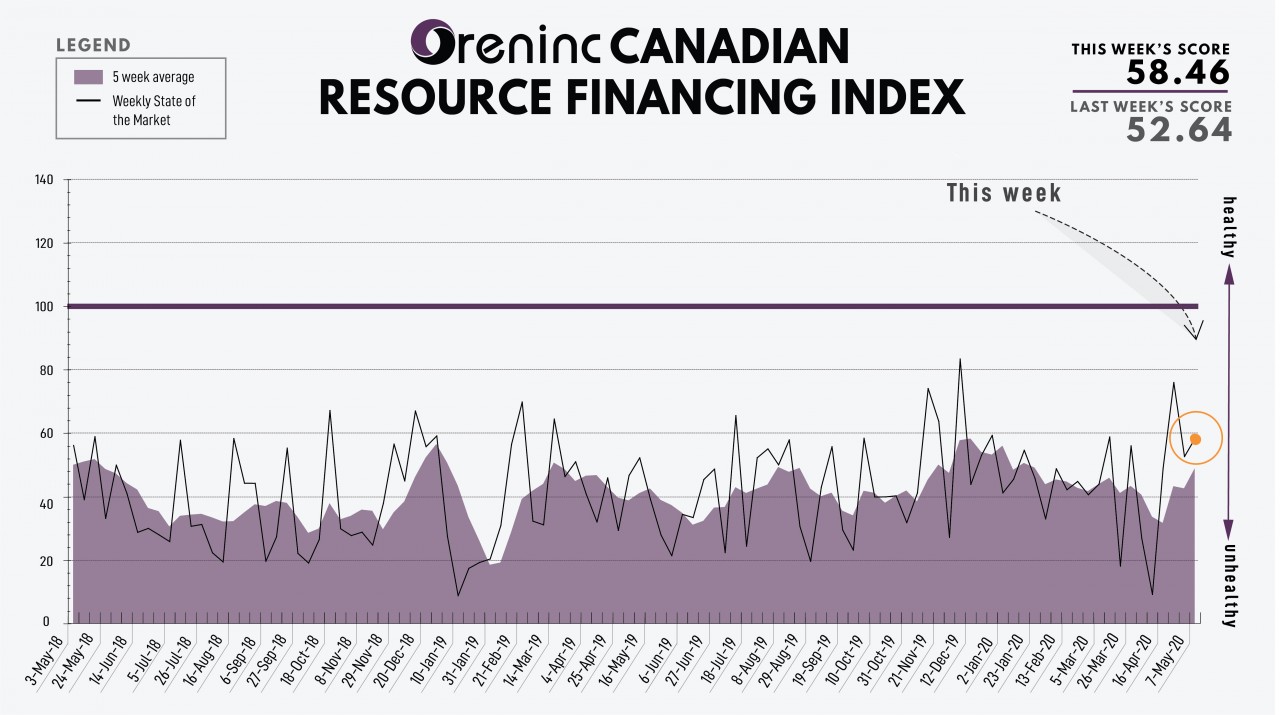

Last Week: 52.64

This week: 58.46

The Oreninc Index increased in the week ending May 8th, 2020 to 58.46 from 52.64 a week ago as the number of brokered deals increased.

The COVID-19 virus global death toll increased to over 275,000 and closing in on 4 million cases reported worldwide.

Figures from the USA show that some 20.5 million people lost their jobs in April according to the Bureau of Labor Statistics, although economist expectations were for 22 million jobs lost. However, the US has lost some 30 million jobs over the past two months and the unemployment rate has increased to 14.7%.

As China gets its economy working again, the US-China trade dispute is coming to centre stage again, but facing the added complication of president Donald Trump claiming China was responsible for the creation and propagation of COVID-19 and threatening to end the phase-one trade deal between if China is not transparent about what happened.

In Europe, the UK—the European country with the highest number of reported COVID-19 deaths—the Bank of England indicated it may expand stimulus from June as the economic fallout from the virus continuous to bite hard. The UK is reportedly dragging its heels in negotiations with the European Union about their future trade relationship which leaves EU negotiators believing that tariffs at the end of the year will be the outcome of failed talks.

The eurozone economy could contract by a record 7.75% in 2020 and see unemployment increase from 7.5% in 2019 to 9.5%, which means the EU itself could become a victim of COVID-19 as large economic divisions are being created between the 19-member putting the entity under considerable financial and political stress. In Germany, the constitutional court warned that cheap credit from the European Central Bank could breach German law.

On to the money: financings continued in fine fettle as the total raises announced decreased to $70.46 million, a four -week low, which included six brokered financings for $31.75 million, a two-week high, and one bought deal financing for $6 million, a three-week low. The average offer size fell considerably to $1.9 million, a four-week low, while the number of financings increased to 37.

Gold continues to consolidate around the US$1,700/oz level as the spot price closed up at $1,702/oz from $1,700/oz a week ago. The yellow metal is up 12.22% so far this year. The US dollar index pared-back again to 93.73 from 99.07 last week. The VanEck managed GDXJ resumed its growth trajectory to close up at $43.09 from $41.30 a week ago. The index is now up for the year, 1.96% so far in 2020. The US Global Go Gold ETF continued to see growth as it closed up at $18.96 from $18.29 a week ago. It is up 7.98% so far in 2020. The HUI Arca Gold BUGS Index closed up at 285.28 from 276.30 last week. The SPDR GLD ETF inventory continued to increase as it closed up at 1,081.65 tonnes from 1,067.9 tonnes last week.

In other commodities, silver is starting to move higher as the spot price closed up at $15.47/oz from $14.98/oz a week ago. Copper also moved higher as it closed up at $2.40/lb from $2.31/lb a week ago. Oil continued to recover as WTI closed up at $24.74 a barrel from $19.78 a barrel a week ago.

The Dow Jones Industrial Average saw growth again as it closed up at 24,331 from 23,723 a week ago. Canada’s S&P/TSX Composite Index closed up again at 14,966 from 14,620 the previous week. The S&P/TSX Venture Composite Index closed up at 492.09 from 473.09 last week.

Summary

- Number of financings increased to 37.

- Six brokered financings were announced this week for $31.5 million, a two-week high.

- One bought-deal financing was announced this week for $6 million, a three-week low.

- Total dollars decreased to $70.46 million, a four-week low.

- Average offer lessened to $1.9 million, a four-week low.

Financing Highlights

Ely Gold Royalties (TSXV:ELY) announced a brokered private placement to raise $10 million, which was subsequently upsized to $15 million.

- 12.5 million units @ C$0.80 upsized by an additional 2.8 million units.

- Syndicate of agents co-lead by Clarus Securities and Mackie Research Capital as joint bookrunners and including PowerOne Capital Markets.

- Over-allotment option could increase raise to $17.25 million.

- Each unit will comprise one share and half a warrant exercisable @ $1 for three years.

- Proceeds will be used for future royalty acquisitions and related project generative activities.

Barrian Mining (TSXV:BARI) opened a non-brokered private placement to raise up to $10 million.

- Units @ $0.22.

- Each unit will consist of one share and a warrant exercisable @ C$0.30 for three years.

- Minimum $7.5 million

- Proceeds will be used to make the initial payments on and exploration of its Kinsley Mountain gold project in Nevada, USA.

Major Financing Openings

- Ely Gold Royalties (TSXV:ELY) opened a $10 million offering underwritten by a syndicate led by Clarus Securities on a best efforts basis. Each unit includes half a warrant that expires in three years. The deal is expected to close on or about May 21st.

- Barrian Mining (TSXV: BARI) opened a $10 million offering on a best efforts basis. Each unit includes a warrant that expires in three years. The deal is expected to close on or about November 30th.

- GR Silver Mining (TSXV:GRSL) opened a $6.02 million offering underwritten by a syndicate led by Beacon Securities on a bought deal basis. Each unit includes half a warrant that expires in a year. The deal is expected to close on or about May 28th.

- Freegold Ventures (TSX:FVL) opened a $5 million offering underwritten by a syndicate led by Paradigm Capital on a best efforts basis. Each unit includes half a warrant that expires in two years. The deal is expected to close on or about November 30th.

Major Financing Closings

- Bluestone Resources (TSXV:BSR) closed a $92.01 million offering underwritten by a syndicate led by Canaccord Genuity on a bought deal basis.

- GFG Resources (TSXV:GFG) closed a $5.91 million offering on a strategic deal basis.

- Canada Nickel (TSXV:CNC) closed a $4.45 million offering underwritten by a syndicate led by PI Financial on a best efforts basis.

- Fortune Bay (TSX:FOR) closed a $2.75 million offering on a best efforts basis.

Comments