ORENINC INDEX up as number of financings increase

ORENINC INDEX - Wednesday, December 21st 2020

North America’s leading junior mining finance data provider

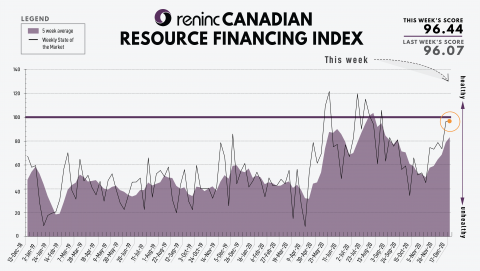

Last Week: 96.07

This week: 96.44

The Oreninc Index increased in the week ending December 18th, 2020 to 96.44 from 96.07 a week ago as the number of financings increased.

The major indices were mostly flat for the week as investors kept a close watch on the coronavirus-related economic relief package. Yesterday was announced that the US government is set to vote on a $900 billion pandemic relief bill.

The COVID-19 virus global death toll is approaching 1.69 million with almost 77 million cases reported worldwide. More and more countries are announcing a hard lockdown with increasing cases.

On to the money: the aggregate financings announced increased to $207 million, a 17-week high, which included one brokered financings for $7.7 million, a 35-week low, and one bought deal financings for 7.7 million. The average offer size increased to $2.96 million, a two-week low, while the number of financings increased to 70.

Gold jumped above the $1,900 level for a brief moment after the pandemic relief bill was announced, but is now back trading around $1,880. The yellow metal closed the week higher at $1,888/oz from $1,843/oz a week ago. The US dollar index closed lower at 90.02 from 90.98 a week ago.

The widely followed junior mining index, the VanEck managed GDXJ, closed the week higher at $54.52 from $51.07 a week ago. The index is now up 30.20%. The HUI Arca Gold BUGS Index, which follows the major gold miners, closed the week higher at 303.38 from 291.68 last week. The SPDR GLD ETF inventory closed the week almost flat at 1,167.82 tonnes, or 37.54 million ounces, from 1,170.15 tonnes last week.

In other commodities, Silver closed the week higher at $26.03/oz from $24.04/oz a week ago. Copper continued to its strength and closed the week at $3.63/lb from $3.52/lb a week ago. Oil went up as WTI closed up at $49.10 a barrel from $46.57 a barrel a week ago.

The Dow Jones Industrial Average closed down at 30,179 from 30,218 a week ago. Canada’s S&P/TSX Composite Index closed up at 17,534 from 17,520 the previous week. The S&P/TSX Venture Composite Index closed up at 816.20 from 769.11 a week ago.

Summary:

• Number of financings increased to 70.

• One brokered financing was announced this week for $7.7m, a 35-week low.

• One bought-deal financing was announced this week for $7.7m, a 4-week low.

• Total dollars heightened to $207m, a 17-week high.

• Average offer decreased to $2.96m, a 2-week low.

Major Financing Openings:

• Solaris Resources Inc. (TSX-V:SLS) opened a $52 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months.

• Otso Gold Corp. (TSX-V:OTSO) opened a $13.97 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 60 months.

• McEwen Mining Inc. (TSX:MUX) opened a $10 million offering on a best efforts basis. The deal is expected to close on or about December 30, 2020.

• Skeena Resources Limited (TSX-V:SKE) opened a $8.5 million offering on a best efforts basis. The deal is expected to close on or about December 21, 2020.

Major Financing Closings:

• Eskay Mining Corp. (TSX-V:ESK) closed a $16.21 million offering underwritten by a syndicate led by Echelon Wealth Partners Inc. on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months. The deal is expected to close on or about December 11, 2020.

• Elemental Royalties Corp. (TSX-V:ELE) closed a $16.12 million offering underwritten by a syndicate led by Canaccord Genuity on a bought deal basis. The deal is expected to close on or about December 15, 2020.

• Bonterra Resources Inc. (TSX-V:BTR) closed a $15 million offering on a best efforts basis. The deal is expected to close on or about December 15, 2020.

• Talon Metals Corp. (TSX:TLO) closed a $11.5 million offering underwritten by a syndicate led by Paradigm Capital Inc. on a bought deal basis. The deal is expected to close on or about December 11, 2020.

Comments