ORENINC INDEX up as number of financings increase

ORENINC INDEX - Monday, February 22nd 2021

North America’s leading junior mining finance data provider

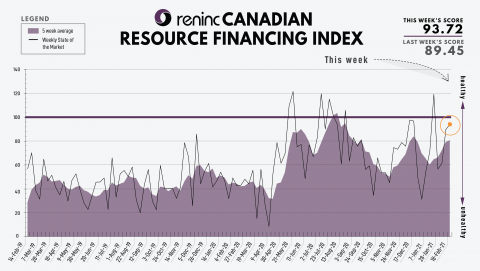

Last Week: 89.45

This week: 93.72

The Oreninc Index increased in the trading week ending February 19th, 2021 to 93.72 from 89.45 a week ago as the number of financings increased.

On to the money: the aggregate financings announced decreased to $148.7 million, a 2-week low, with 8 new brokered financings and 3 new bought-deal financings announced. The average offer size increased to $3.5 million, a 2-week low, and the number of financings increased to 42.

Gold closed the week lower at $1,777/oz from $1,823/oz a week ago. The US dollar index closed lower at 90.36 from 90.48 a week ago.

The widely followed junior mining index, the VanEck managed GDXJ, closed the week down at $47.54 from $50.25 a week ago. HUI Arca Gold BUGS Index, which follows the major gold miners, closed the week lower at 263.56 from 284.29 last week. The SPDR GLD ETF inventory closed the week down at 1,127.64 tonnes, or 36.25 million ounces, from 1,143.22 tonnes last week.

In other commodities, Silver closed the week higher at $27.25/oz from $27.32/oz a week ago. Copper closed the week at $4.07/lb from $3.78/lb a week ago. Oil went higher as WTI closed down at $59.24 a barrel from $59.47 a barrel a week ago.

The Dow Jones Industrial Average closed up at 31,494 from 31,458 a week ago. Canada’s S&P/TSX Composite Index closed down at 18,384 from 18,460 the previous week. The S&P/TSX Venture Composite Index closed up at 1098.56 from 1067.44 a week ago.

Summary:

· Number of financings increased to 42.

· Eight brokered financings were announced this week for $83.7m, a 2-week low.

· Three bought-deal financings were announced this week for $54.7m, a 2-week low.

· Total dollars decreased to $148.7m, a 2-week low.

· Average offer lessened to $3.5m, a 2-week low.

Major Financing Openings:

· Horizonte Minerals plc (TSX:HZM) opened a $ =INT( 31,700,000.00 )/1000000 31.7 million offering underwritten by a syndicate led by Paradigm Capital Inc. on a bought deal basis. The deal is expected to close on or about March 3, 2021.

· Osisko Development Corp. (TSX-V:ODV) opened a $ =INT( 22,999,980.00 )/1000000 23 million offering underwritten by a syndicate led by Eight Capita on a bought deal basis. The deal is expected to close on or about March 18, 2021.

· Treasury Metals Inc. (TSX:TML) opened a $ =INT( 15,003,500.00 )/1000000 15 million offering underwritten by a syndicate led by Cormark Securities Inc. on a best efforts basis.

· Maritime Resources Corp. (TSX-V:MAE) opened a $ =INT( 10,001,030.00 )/1000000 10 million offering underwritten by a syndicate led by Canaccord Genuity Corp. on a best efforts basis. The deal is expected to close on or about March 22, 2021.

Major Financing Closings:

· Osisko Mining Inc. (TSX:OSK) closed a $ =INT( 70,004,750.00 )/1000000 70 million offering underwritten by a syndicate led by Canaccord Genuity Corp on a bought deal basis. The deal is expected to close on or about February 12, 2021.

· Gold Standard Ventures Corp. (TSX:GSV) closed a $ =INT( 34,509,200.00 )/1000000 34.51 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis. The deal is expected to close on or about February 17, 2021.

· Argonaut Gold Inc. (TSX:AR) closed a $ =INT( 26,450,232.30 )/1000000 26.45 million offering underwritten by a syndicate led by Cormark Securities Inc. on a bought deal basis. The deal is expected to close on or about February 11, 2021.

· Dore Copper Mining Corp. (TSXV:DCMC) closed a $ =INT( 10,998,900.00 )/1000000 11 million offering underwritten by a syndicate led by Cormark Securities Inc. on a best efforts basis. The deal is expected to close on or about February 18, 2021.

Comments