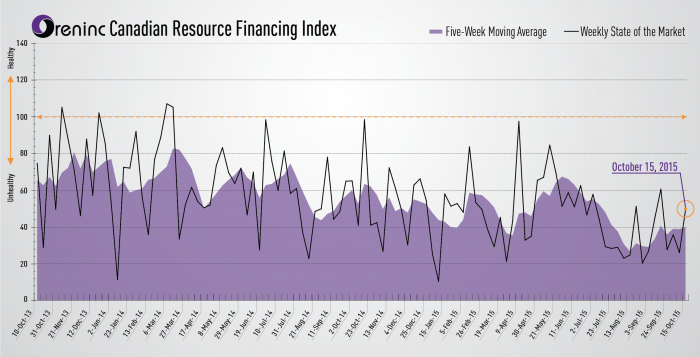

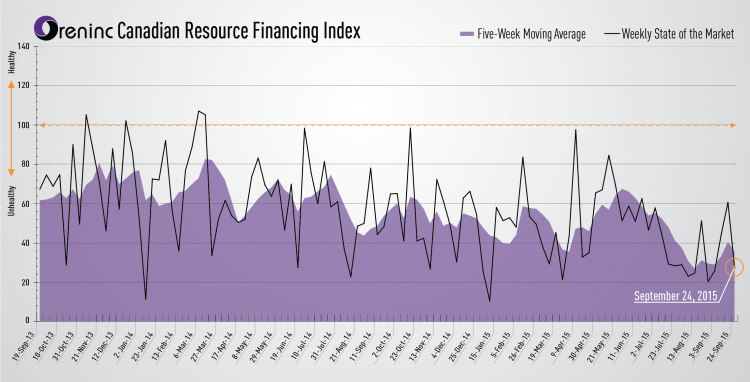

Oreninc Index Jumps to Four-Week High

The Oreninc Index jumped to a four-week high for the holiday-shortened week ending October 19, 2015. Total dollars announced exploded to $129.8m, a four-week high. No brokered financings were announced for the third time in four weeks; no bought deals were announced for the fourth straight week.

The top dealmaking news of the week was reports that Mick Davis’ X2 Resources appears to be the last remaining bidder for Rio Tinto Group’s (NYSE:RIO) Australian Hunter Valley coal assets, with talk of a deal that could be around US$2.2bn. The gold price exploded for the week, hitting its highest price in almost four months.

While it is only one week, it is nice to see some activity after a couple of disappointing weeks. Still, the lack of brokered deals remains a concern, and we will see if more companies attempt to raise large amounts of cash via non-brokered deals.

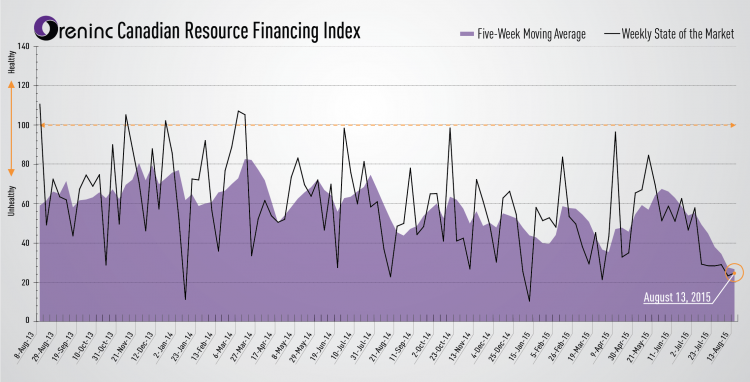

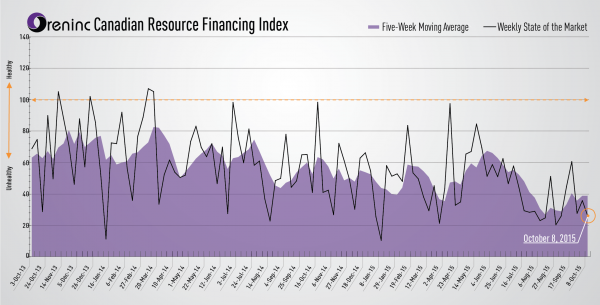

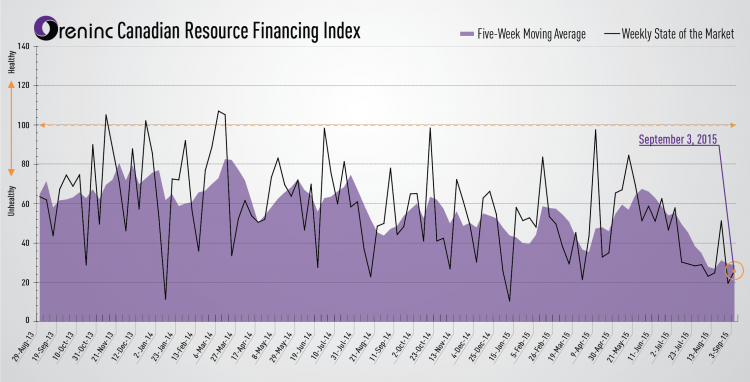

Oreninc Index Falls to Lowest Level of Summer

The Oreninc Index fell to it’s lowest level of the summer for the week ending August 27, 2015. Total dollars fell sharply...

Oreninc Index Falls to Lowest Level of Summer

The Oreninc Index fell to it’s lowest level of the summer for the week ending August 27, 2015. Total dollars fell sharply... Oreninc Index Rises to Respectability

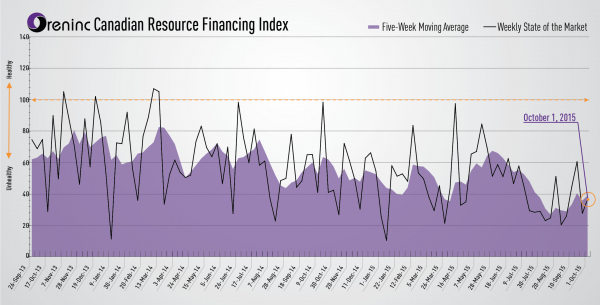

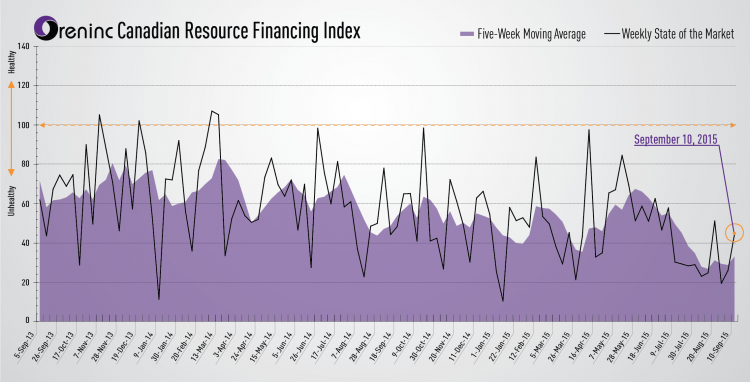

The Oreninc Index improved to a respectable level for the week ending August 20, 2015. Total dollars announced jumped to $113.1m, a seven-week high. Two...

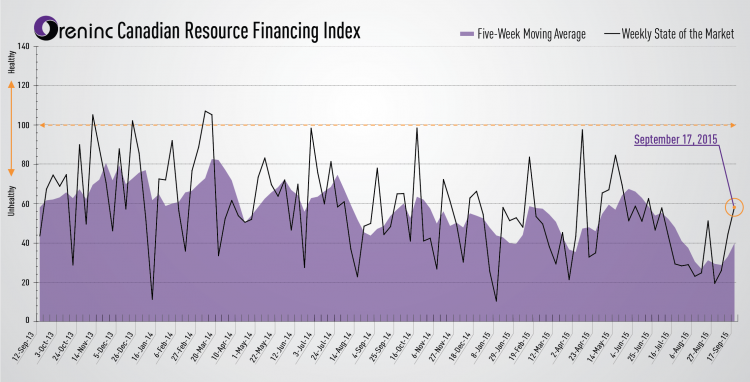

Oreninc Index Rises to Respectability

The Oreninc Index improved to a respectable level for the week ending August 20, 2015. Total dollars announced jumped to $113.1m, a seven-week high. Two...